Стратегия «Скальпинг» на криптобирже Binance

Скальпинг — не изобретение трейдеров цифровых валют, эта стратегия появилась давно и неплохо себя показала в работе. Но сейчас она чаще всего применяется именно при торговле криптовалютами. Её название полностью отражает суть: это словно снятие «скальпа», получение поверхностной прибыли с быстрой сделки.

Содержание страницы

Процесс скальпинга состоит из трех этапов: поиска подходящего диапазона цены по графику, отслеживания и подтверждения готовности крупных игроков двигаться в определенном направлении, выбора оптимальной стоимости для совершения сделки.

Инструменты стратегии

Скальпинг – стратегия дневного трейдинга. Она не подразумевает глубокого анализа, на это просто нет времени, таймфрейм может быть ограничен даже 1 минутой, после чего сделка закрывается и открывается новая.

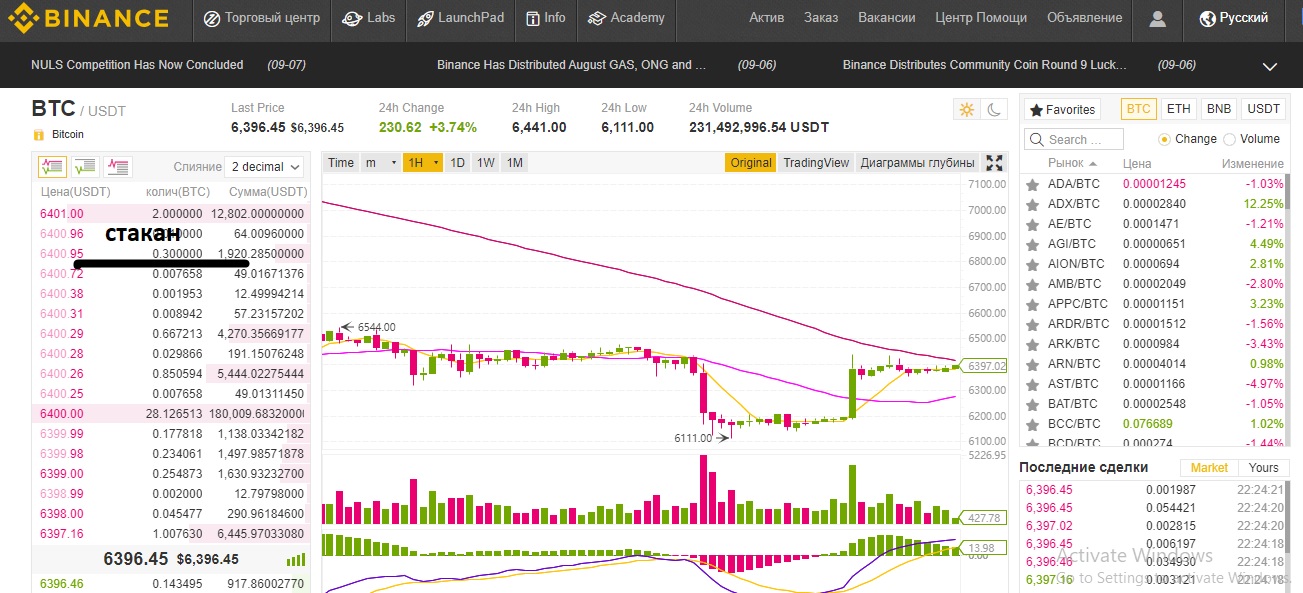

Трейдеры, ради поиска точных сигналов динамики активов, могут пользоваться данными торгового стакана, а некоторые из них дополнительно отслеживают поведение индикатора Индекс относительной силы RSI, линий поддержки и сопротивления. Но оценка ситуации на рынке в любом случае делается очень поверхностная.

Считается, что скальпинг эффективнее всего работает для пар биткоин-альткоины. При этом важно, чтобы торговая площадка позволяла устанавливать стоп-лоссы. У Binance такая возможность есть и обмен здесь производится только между валютами, поэтому на этой криптобирже стратегия скальпинга популярна.

Прибыль

Условиями прибыльности скальпинга являются волатильность криптовалюты, быстрота реакции и опыт трейдера. На слабоволатильных монетах (около 1-2% в день) посредством стратегии много заработать не получится. Оптимально, если их цена колеблется в день на 15-20% или те же 1-2%, но в пределах нескольких минут. В то же время, волатильность не должна быть чрезмерной. Считается, что оптимально использовать скальпинг при флэте рынка, когда есть колебания цен, но нет их резких скачков.

В этом случае прибыльность торговли может достигать от 10% до 50% и даже 100%. При этом от других стратегий скальпинг отличается большой долей неуспешных сделок. В зависимости от опыта трейдера, прибыльными могут быть от 60% до 70% заявок. Прибыль от удачных сделок к тому же должна покрывать убытки безуспешных.

Скальпинг довольно часто рекламируется как наиболее простой способ трейдинга, которым могут пользоваться новички. Это не так. Как раз данная стратегия, при видимой простоте, предполагает, что трейдер хорошо ориентируется на цифровом рынке вообще и на той криптобирже, на которой торгует, в частности. На платформе Binance для того, чтобы превысить показатели удачных сделок над убыточными, может понадобиться до полутора лет.

Что еще нужно знать

Скальпить с малым депозитом не имеет особого смысла. Прибыль от каждой сделки не слишком велика, значительной она может быть в сумме, после закрытия множества коротких заявок в течение какого-то времени. Позиции нужно постоянно наращивать, для этого на счету должна быть немалая сумма, особенно в период обучения работе по стратегии, когда большинство сделок, скорее всего, будут убыточными.

При скальпинге на криптобирже важно учитывать размер комиссии платформы за проведённые транзакции. Binance () отличается одной из самых небольших комиссий среди подобных платформ и это тоже одна из причин, по которой скальпинг здесь популярен. И всё-таки, трейдер проводит десятки транзакций в течение одной сессии и суммарно даже небольшие сборы выливаются в существенные расходы, о чём также стоит помнить.

При реализации скальпинга неизбежны убыточные сделки. Некоторые трейдеры считают, что нужно усреднять результаты торгов, но у них есть немало оппонентов, которые считают это пагубной тактикой работы. Поскольку это не только краткосрочная, но и высокочастотная стратегия, то предполагается, что лучше завершить неудачную сделку и заключить новую, уделив больше внимания оценке ситуации.

Пример работы по стратегии на Binance

- ;

- Если мы собираемся использовать в работе дополнительные индикаторы, например, RSI, то в разделе «Торговый центр» необходимо выбрать режим «Расширенный». Далее, в появившемся подразделе нужно кликнуть на вариант Technical Ind, где в списке инструментов можно найти индикатор.

Или готовимся в работе ориентироваться только по стакану, в котором нужно определить соотношение спроса и предложения по активу. Тогда в меню «Торговый центр» нужно выбрать режим «Основной».

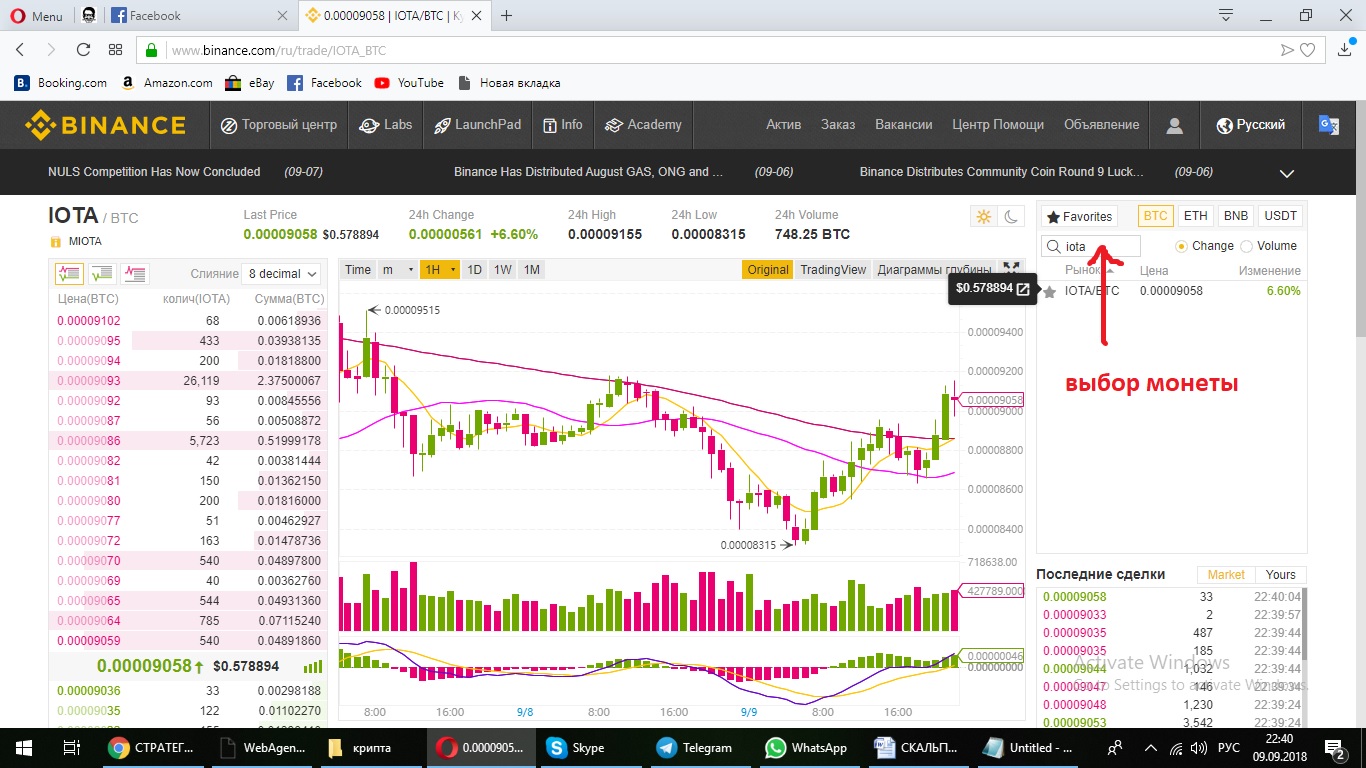

Устанавливаем нужный нам таймфрейм

Подбираем криптовалюту. Монет на бирже много, их ценовая динамика всегда разнообразна и задается, преимущественно, изменениями курса биткоина, но есть и исключения. Стоит поторопиться с выбором актива, чтобы он был пригоден к скальпингу, позволил вам получить максимальную прибыль с торгов.

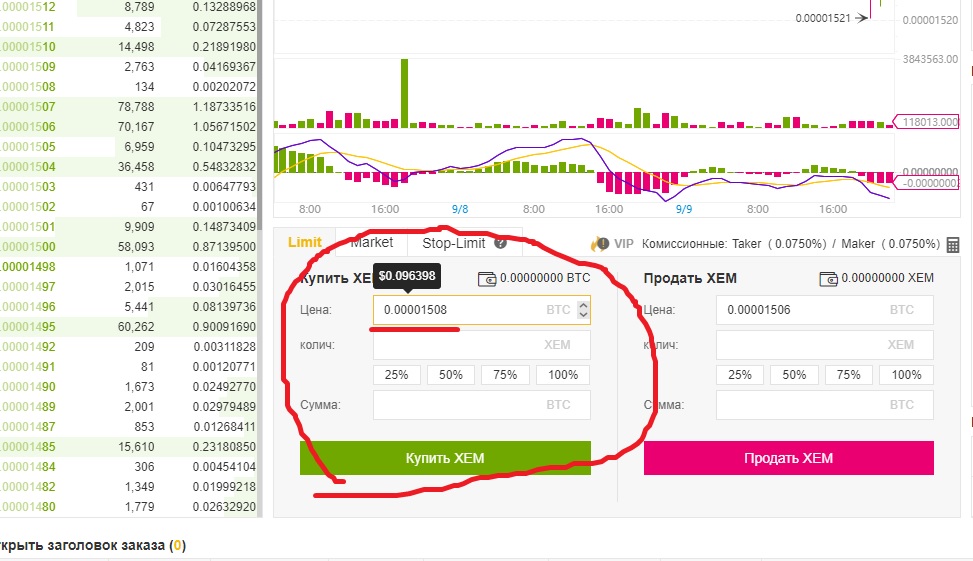

Посмотрим в стакане, нет ли больших сделок? Кажется, IOTA сегодня не пользуется особым спросом, попробуем посмотреть другую монету, например XEM. Здесь у нас есть одна относительно крупная сделка.

Мы предполагаем, что после этой покупки цена монеты немного вырастет и ставим свою позицию перед ценой, чуть выше.

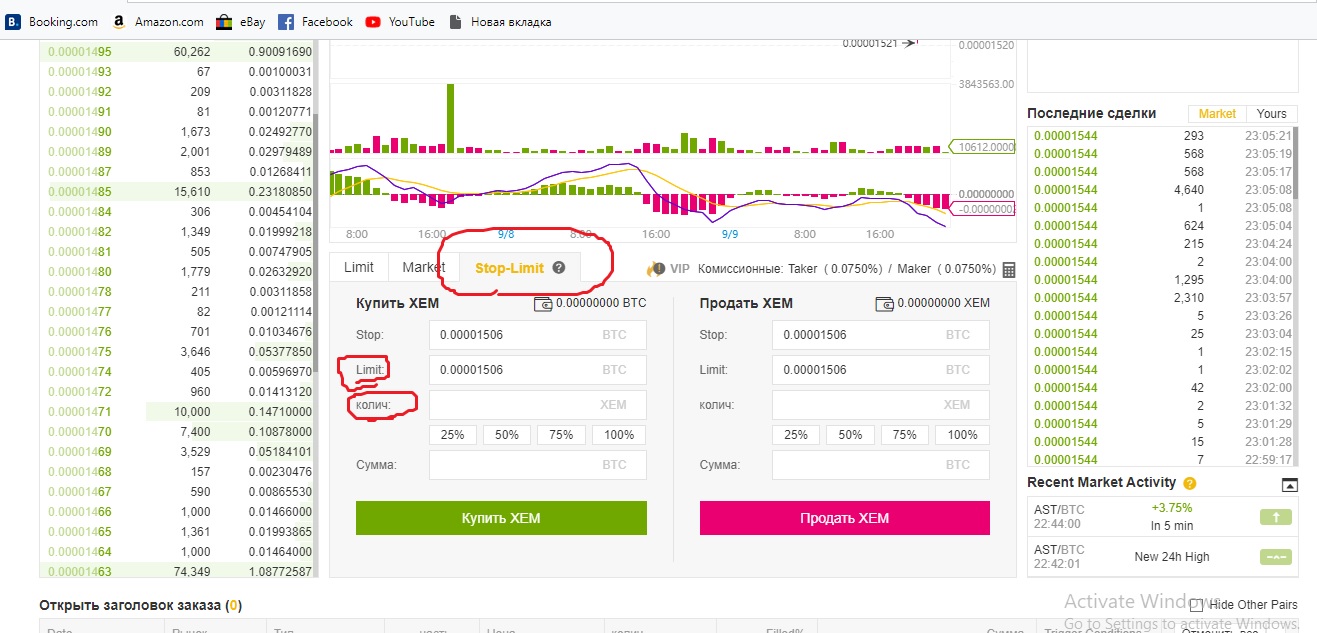

Также ставим стоп-лосс вслед за ценой, заполняя соответствующие графы и покупаем монеты.

Действовать нужно быстро, так как скальпинг — популярная стратегия. На графике можно увидеть, как сразу после появления большой сделки здесь выстраивается целый ряд позиций трейдеров, зарабатывающих на внутридневных торгах. После того, как совершена сделка, закройте её, оцените ситуацию и результат торгов, повторите весь цикл снова.

Барьеры

Основная сложность скальпинга на криптобирже заключается в том, что даже опытный трейдер, имея на руках все инструменты и обладая всей полнотой информации, не может достаточно точно прогнозировать цену, потому что цифровой рынок высокоманипулятивен. Например, увидев крупную сделку в стакане, можно предположить, что вслед за ней цена вырастет. Но когда подойдёт время реализации крупной сделки, трейдер просто отменяет её. И цена идет совсем не туда, куда должна была идти по мнению скальпера.

В торги могут зайти крупные игроки «киты», задача которых — «стричь хомяков», мелких игроков. Киты могут реальными крупными покупками и продажами начать раскачивать рынок. «Качели» — плохой момент входа в торги для скальпера, определить их можно не сразу. Скачки цен криптовалют могут начаться вообще без каких-то видимых причин в глобальном масштабе.

Эти особенности могут привести к тому, что трейдер останется вообще без прибыли. Поэтому рекомендуется скальпить, рискуя не более 20% от депозита, иначе буквально одна неудачная ставка может дорого обойтись игроку.

Также проблемой является слишком эмоциональное поведение трейдера. Поскольку времени на глубокий анализ нет, то он может открыть позицию, полагая, что его действия продиктованы хорошим пониманием ситуации, но не отдавая себе отчет в том, что он просто идет на поводу у азарта.

Отдельно стоит отметить, что криптовалютные биржи работают не всегда так точно и быстро, как хотелось бы. Иногда сделки притормаживаются, что может привести скальпера к убыткам, даже если он сделал всё правильно – для этого хватит и доли секунды.

Комментарии

Автор пишет что для скальпинга нужен большой депозит ОСОБЕННО на стадии обучения потому что будут убытки.

А зачем на стадии обучения большой депозит??? Это же обучение там одни сливы будут. Наоборот нужен маленький депозит 10-100 долларов закинул и сидишь тренируешься

Научу скальпить на moon bot

Вадим : + 7 934 444 69 66 WhatsApp

На бинансе можно скальпить автоматически при помощи stratum-bot

на бинансе не может быть скальпинга из-за комиссии

С чего бы это?! Там самая низкая комиссия

Это ложное утверждение. На Quantfury вообще нет комиссии. 0%. При этом торговля может вестись в том числе и по стакану Binance (спотовому). Единственная существенная особенность Quantfury — принудительное и неизменяемое 20-е плечо. Ну и отсутствие десктопной версии подмучивает, но мобильный клиент очень хорошо реализован, торговать удобнее, чем через мобильное приложение Binance. Одно то, что все ордера, включая стопы, можно просто отредактировать (а не как на Binance их сперва надо удалить, а потом поставить новые с новыми параметрами), делает честь разработчикам.

С помощью Moon Bot скальпится влет. Ещё BNB прикупить и комса меньше будет

Дада за каждую сделку 200 рубашка к

Какой скальпинг