Торговля криптовалютой на бирже

Торговля криптовалютой — перспективное направление в интернет-трейдинге, которое дает возможность получить доход на торговле цифровыми валютами. Возникнув не так давно (с 2009 года), криптовалюта предложила более совершенный подход к деньгам для расчетов в интернете: без контроля, комиссий и посредников, способствовала появлению огромного по масштабам рынка с невероятной рентабельностью, баснословными доходами, полноценной криптоэкономикой с ее новыми законами и правилами.

Все это буквально «захватило умы» тех, кто интересуется современными технологиями и дополнительными источниками дохода. Итак, что же такое торговля криптовалютой и как заработать? Поговорим об этом в нашей обзорной статье.

Что такое торговля криптовалютой и как на этом заработать?

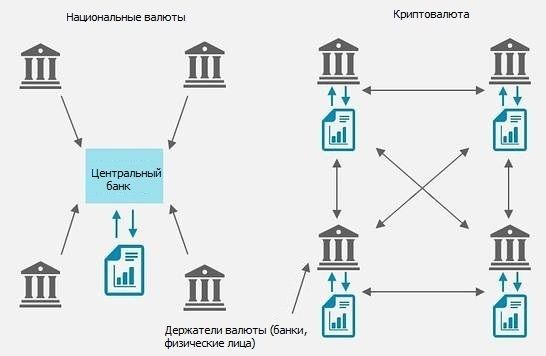

Прежде чем ответить на вопрос, что такое торговля цифровой валютой, стоит дать определение понятию криптовалюта: это цифровая (виртуальная) валюта, единица которой – монета (англ. -coin), которая эмитируется в сети, не связана с обычной валютой или какой-либо государственной валютной системой; если сказать простыми словами, это электронные деньги.

Торговля криптовалютой — это тот же интернет-трейдинг, но в данном случае, вместо привычных активов (валюты, акции, облигации и т.д.), трейдер торгует цифровыми валютами (например, биткойном, лайткойном, кварккойном и т.д.). Этот рынок динамичен и непредсказуем, внимание к нему постоянно «подогревается» быстрым ростом цен, «сумасшедшими скачками» курса валют. Такая возможность заработать на криптовалюте в короткие сроки баснословный доход стала предметом жарких споров: кто-то принимает криптовалюту, кто-то выступает против неё, однако её существование на рынке оправданно и особенно ценно в эпоху всеобщей глобализации и развития интернета.

Трейдеры покупают цифровую валюту по наиболее выгодному курсу и продают ее, выжидая подъема стоимости. Для того, чтобы торговать цифровой валютой, вам не нужно выполнять сложные манипуляции, основными вашими инструментами будут: графики, по которым можно определить тенденцию валюты: вверх или вниз, спад или рост; ордера – или иначе, запросы игроков крипторынка на покупку или продажу валюты; история сделок, которая поможет отследить список операций на бирже и при помощи каких инструментов они происходили; объёмы торгов, эта информация поможет точно определить то, какие объёмы криптовалюты перешли из одних рук в другие. Конечно же, вам доступны индикаторы, стратегии, торговля автоматическими роботами, можно зарабатывать с помощью майнинга, облачного майнинга.

ТОП-5 криптобирж для знакомства с рынком

| Биржа | Бонусы | Регистрация |

|---|---|---|

1 | До 50 USDT Подарок за регистрацию и первый депозит | Перейти |

2 | 20 % Скидка на комиссии биржи | Перейти |

3 | 2 USDT Приветственный бонус | Перейти |

4 | До 100 % Скидки по пакетам EXMO Premium | Перейти |

5 | 100 USD Бонус за депозит 100 USD | Перейти |

Нестабильность рынка, постоянный рост или падение курса, повышенные риски, с которыми сталкиваются инвесторы, вызвали, если можно так сказать, целую «криптовалютную лихорадку»: сегодня все вовлечены в разговоры о том, когда «лопнет» цифровая валюта и что же будет дальше? Благодаря новостям, сенсационным заявлениям и громким заголовкам мы все знаем о том, когда происходит резкий скачок стоимости таких валют, когда они падают в цене.

Волатильность криптовалют в сотни раз выше, нежели ее показатель среди традиционных вариантов трейдинга. Однако торговля криптовалютой — это еще и риски потерей, и, если вы не успели отследить изменение тенденции, существует риск потерять свой капитал. К рискам относится и то, что будущее криптовалюты, если можно так сказать, туманно и сегодня не совсем понятно, что будет после того, как этот «пузырь лопнет». Кроме того, криптобиржи могут быть заблокированы, взломаны, также и вашу учетную запись могут взломать по причине ненадежного пароля, и, т.к. биржа не несет ответственность за такие ситуации, все убытки ложатся полностью на плечи трейдеров. Разумеется, все эти риски не останавливают инвесторов торговать криптовалютой и получать огромную прибыль, возможность быстрого заработка в самое ближайшее время привлекает сегодня к торговле криптовалютой все большее количество заинтересованных игроков рынка.

Прибыльная стратегия торговли на бирже криптовалют — то, что способно принести спекулянту хорошие результаты работы. Это один из первых моментов, о котором трейдеру приходится задумываться, если он заинтересован в постоянном заработке с цифровых активов. Вы должны понимать, что выбор брокера или надежной криптобиржи — это лишь часть дела. В сети представлены разные стратегии торговли криптовалютой, среди них есть как действенные методики работы, так и неэффективные системы. Но как среди всего этого разнообразия выбрать ту стратегию, которая действительно принесет вам прибыль? Предлагаем вам ряд наиболее распространённых у профессиональных инвесторов в криптоактивы стратегий торговли на криптовалютной бирже.

- Торговля по тренду. Эта классическая методика. Следование общему восходящему тренду не требует от игрока глубоких познаний рынка, умения работы с индикаторами. Для этой стратегии важно выбрать правильный момент для приобретения желаемого актива, который наглядно говорит о том, что в ближайшее время у монеты наблюдается тенденция к повышению ее цены.

- Покупка и удержание активов. Еще один из классических методов работы с криптовалютами, который неосознанно используется большинством трейдеров. Особенность этой стратегии заключается в том, что инвестор, приобретя цифровую монету, удерживает ее в ожидании удорожания ее цены и реализации по более выгодному предложению. Здесь для правильного прогнозирования курса криптовалюты необходимо будет обращаться к фундаментальному анализу рынка, т.к. на характер долгосрочных вложений влияет спрос пользователей, а также крупных инвесторов.

- Совершение сделок «на откат» до прежнего момента. Такая стратегия отличается тем, что дает более активную торговлю, распространена у тех игроков, которые работают на краткосрочных периодах. Трейдер открывает сделку по направлению против тренда в ожидании роста цены монеты до прежнего момента (уровня). В этой методике торговли помогает особенно тот факт, что рынок цифровых валют имеет высокую волатильность. Для успешного результата профессионалы советуют пускать в ход не более 2% капитала от средств депозита.

Как вы понимаете, важное значение на данном рынке имеет стратегия торговли на бирже криптовалют. Видео-материалы, а также комментарии трейдеров в сети отмечают в качестве результативных методик работы еще и скальпинг и торговлю на новостях. В чем же причина успешности одних спекулянтов и постоянные проигрыши других? Вы должны постоянно тестировать новые стратегии торговли криптовалютами, пробовать что-то новое и не стоять на месте. Развитие — необходимое условие прибыльного трейдинга, помните об этом.

Торговля на бирже криптовалют для чайников уже давно стала популярным вопросом в сети и все потому что больше и больше людей стремятся найти для себя возможность приличного заработка. Конечно же, в последние два-три года крипто торговля стала невероятно популярной, среди наших знакомых, сослуживцев и друзей много тех, кто открыл для себя цифровую валюту. Все это впечатляет, рынок растет, удивляя своей динамикой, волатильностью. Внушительное число трейдеров все чаще уверенно заявляют, что источником основной занятости для них является торговля на бирже криптовалют. Отзывы, видео уроки, многочисленные конференции в сети — все это доказывает популярность цифрового рынка.

И вот вы тоже, узнав у своих друзей, прочитав отзывы трейдеров и собрав какую-то сумму денег, решили попробовать свои силы в криптовалюте. С чего вам начать работу, ведь вряд ли здесь все так просто? Действительно, вы правы. Чтобы правильно начать работу и знакомство с этим рынком стало для вас комфортным, стоит изучить некоторые простые принципы торговли на бирже криптовалюты, те моменты, которые обязательно помогут вам быстрее освоиться здесь и стать профессионалом:

- Познакомьтесь с особенностями технического анализа, который поможет, при помощи дополнительных инструментов (индикаторы, осцилляторы, графические линии и т.д.) правильно увидеть картину рынка и его перспективы.

- Изучите рынок популярных и самых ликвидных активов. Для этого на криптобиржах есть стаканы торгов, история сделок — эти данные покажут вам заинтересованность трейдеров конкретными активами, а значит, вы можете прислушаться к настроению массы и сделать то решение, которое принесет вам прибыль. Иизучайте новости, современные тенденции рынка — это тоже даст свои плоды.

- Определитесь с платформой, на которой будете работать (это может быть как биржа, так и терминал брокера) — она должна отличаться комфортностью для вас, информативностью (набор инструментов для анализа, качественная аналитика и т.д.).

- Торгуйте по трендам рынка, — по одной из самых популярных торговых систем, позволяющих не рисковать своими средствами и зарабатывать максимум капитала. Пробуйте и другие стратегии, которые показывают хорошую результативность.

- Используйте возможности кредитного плеча. Что такое маржинальная торговля на бирже криптовалют? На самом деле все просто и, если с этим инструментом осознанно работать, это принесёт свои положительные результаты. Итак, маржинальная торговля цифровыми монетами — это возможность торговать на платформе не только своими средствами, но и заемным капиталом, который берётся у брокера под залог своих активов. Для чего это нужно? Чтобы торговать большими объемами валют и получать более высокий доход, чем в том случае, если бы вы пользовались только своим капиталом. Это выгодно и бирже, и игроку. Если брокер получает проценты с такого трейдинга, то сам спекулянт, правильно распоряжаясь средствами, имеет возможность заработать внушительный доход, всего лишь временно одолжив средства у своего брокера.

Интересно, что широкое распространение у спекулянтов получила именно торговля криптовалютой на бирже. Видео и отзывы игроков наглядно свидетельствуют о том, что инвестировать здесь и выгодно, и доходно. Многие трейдеры, имеющие опыт работы с другими финансовыми рынками, обращаются именно к цифровым активам, пробуют торговать у брокера или изучают возможности криптобирж. В чем же здесь главное преимущество для вас? Вы ничем не ограничены, занимаясь цифровой валютой, и этот рынок имеет огромные возможности для вас, поэтому, помня наши рекомендации для «чайников», можете смело приступать к знакомству с криптотрейдингом.

Основные понятия при торговле криптовалютой

Криптовалюта (cryptocurrency) — цифровая валюта, выпускаемая путем решения математических задач, основанных на криптографии.

Криптография (cryptography) — «язык» математики, используемый при создании шифров и кодов для того, чтобы обезопасить и скрыть информацию; применяется при подтверждении транзакций биткойнов.

Блокчейн (blockchain) — реестр/база данных или «журнал транзакций».

Майнинг (mining с англ. — добыча полезных ископаемых) — это добыча цифровой валюты (криптовалютного программного кода) с помощью вычислительных мощностей; вычислительные мощности предоставляются пользователями для генерации новых блоков транзакций, при этом пользователь может рассчитывать на вознаграждение в виде криптомонет.

Майнеры (miner) — люди, занимающиеся майнингом, то есть добычей криптовалюты — поиском из миллионов комбинаций единственного правильного кода (его еще называют хэш), что обеспечивает майнерам получение вознаграждения.

Биржа криптовалют – торговая площадка, которой пользуются трейдеры, объединённые целью получить доход с торговли криптовалютой.

Биткойн — первая в мире криптовалюта, которая была доступна трейдерам в качестве цифровой валюты.

Сатоши (satochi) — самая маленькая неделимая частица валюты биткойн (или еще биткойн-копейка; 1 биткойн — 100 000 000 сатоши).

Альткойн (altcoin) — общее название криптовалют, которые предлагаются рынком в качестве альтернативы биткойну.

Форк — криптовалюта, появившаяся на рынке позднее биткойна и других альткойнов, которая является ее частичным аналогом.

Кран, фаусет (faucet) — специальный интернет-ресурс, на котором пользователи могут получать криптовалюту за выполненные задания.

Памп — массовое приобретение цифровой валюты с целью искусственного повышения ее курса.

Дамп – запланированный «обвал» курса крупными игроками.

Фиат, фиатные валюты — реальные деньги, цена которых устанавливается государством (рубль, доллар, евро и т.д.).

Зачем нужен брокер криптовалют?

Сначала на торговле криптовалютами зарабатывали с помощью майнинга, затем для того, чтобы начать работу с виртуальными деньгами, все трейдеры проходили регистрацию на криптобирже. Так происходит и сейчас, но, т.к. рост популярности цифровой валюты продолжился, появился криптовалютный трейдинг, который происходит с помощью брокеров криптовалют.

Почему брокер криптовалюты лучше, чем биржа криптовалют? Если вы не имеете опыта торговли на финансовых рынках, эта информация будет иметь для вас ключевое значение и, зная о недостатках криптобирж, вы сбережете и свои деньги, и зря потраченное время. Начиная торговать криптовалютой, вы должны знать, что часто биржи криптовалют предоставляют своему пользователю очень сложный торговый терминал, с которым бывает сложно разобраться не только новичкам трейдинга, но и профессионалам. Брокер криптовалют, предлагая в качестве одного из активов криптовалюту, дает возможность торговать трейдеру в привычных условиях. Зачастую торговля на криптобирже бывает совершенно невыгодной начинающим трейдерам: это большие размеры депозитов, комиссии, платы за обслуживание, за проведенные сделки, высокая цена перевода денег на кошелек.

Один из самых главных негативных моментов криптобирж — они не обладают достаточным уровнем безопасности и надежности, часто подвергаются атакам хакеров и закрываются; при этом, если ваш аккаунт взломали, биржа не вернет вам потерянные деньги. У брокеров криптовалют, конечно же, тоже есть минусы (например, ограниченное количество криптовалют), но плюсов достаточно, поэтому большое количество трейдеров торгуют на надежных торговых площадках. Такие брокеры стараются предоставить качественный сервис, обучающие программы, полезный материал на родном языке, также вы можете задать вопросы в службу поддержки и получить грамотный ответ. Торговать здесь проще и комфортнее, чем на криптобирже.

Платформа для торговли криптовалютой

Платформа для торговли криптовалютой позволит комфортно работать с цифровой валютой, сделает трейдинг функциональным. Правильно выбрав платформу для торговли криптовалютой, вы сможете организовать работу более продуктивно и сосредоточиться на главном. Сегодня торговать цифровыми валютами можно либо на криптобирже, либо у брокеров криптовалют.

Выбрав для работы криптобиржу, вы столкнетесь с тем, что таких площадок очень много в интернете. Как выбрать подходящую именно вам? Хорошие платформы для трейдинга криптовалютой (например, ByBit (), Garantex (), OKX () имеют следующий набор характеристик:

- Большое количество предлагаемых цифровых валют, как популярных, так и менее популярных, набирающих торговые обороты. Чем больше выбор монет, тем выгоднее будет вам работать.

- Быстрый и удобный ввод и вывод средств. Криптобиржи стараются предложить пользователю разнообразие способов перевода средств: это могут быть платежные терминалы, банковские переводы и т.д.

- Возможность обмена цифровых валют в рубли и т.д. Эта функция представлена не на всех площадках.

- Язык платформы. Часть криптобирж старается предоставить российскому трейдеру материалы и поддержку на родном языке, но похвастаться этим могут не все площадки. Что касается работы тех.поддержки, то здесь все очень сложно и, либо вы не сможете связаться с менеджерами, либо в лучшем случае она будет на английском языке.

- Наличие мобильных приложений, которые позволят торговать, находясь в любой точке планеты.

- Инструменты для торговли и анализа информации (ордера, графики, графические элементы, индикаторы и т.д.). Чем больше в вашем распоряжении дополнительных инструментов, тем больше шансов увеличить свой капитал и снизить риски.

- Безопасность платформы — это одна из ключевых задач криптобирж и, привлекая на площадку трейдеров, биржи обещают, что при выполнении всех рекомендаций по безопасности (сложные пароли, двухфазная авторизация и т.д.) трейдер может спокойно торговать, не переживая о том, что его аккаунт взломают и все деньги пропадут. Несмотря на это, взломы и хакерские атаки — то, что сегодня продолжает серьезно угрожать биржам, однако, советуем все-таки следовать рекомендациям по безопасности ресурсов.

- Положительные отзывы трейдеров о работе на бирже.

Все эти параметры будут действовать и при выборе трейдером брокера криптовалюты. Однако что выбрать трейдеру для торговли, — криптобиржу или брокера криптовалюты, решать только самим игрокам рынка. Не все брокеры криптовалюты готовы предложить максимальный функционал для работы с цифровой валютой: торговлю и обмен криптовалюты, возможность трейдинга в выходные дни, когда традиционные биржи закрыты, реализацию более широких спредов во время сильной волатильности рынка, предоставление комфортных комиссий и взносов при обслуживании торговли цифровой валютой.

Торговля криптовалютой на Android и Apple

Торговля криптовалютой — это серьезная работа, результативность которой зависит от постоянного отслеживания тенденций рынка и, благодаря развитию технологий, делать это сегодня проще. Мобильные приложения на Android и Apple позволят торговать тогда, когда вам это удобно, из любой точки мира, абсолютно в любое время. Они содержат необходимый функционал для комфортной торговли 24 часа в сутки, позволят не только торговать цифровой валютой, вовремя реагируя на изменения рынка, но и удобно и быстро выводить средства.