Фондовый рынок что это? Особенности

Фондовый рынок — это, согласно Википедии, совокупность экономических отношений по поводу выпуска и обращения ценных бумаг между его участниками.

Фондовый рынок, кроме экономических, включает в себя иные отношения (юридические, общественные и т.д.), которые призваны обеспечить постоянный оборот ценных бумаг, необходимый для инвесторов (частных лиц), которым важно получение личного дохода (для личных целей: покупка квартиры и т.д.), а также компаний, размещающих свои акции чтобы стабильно получать инвестиции, которые нужны для развития бизнеса, оптимизации его процессов.

Сейчас многие из нас начинают всерьез задумываться о получении дополнительного дохода с помощью торговли на финансовых рынках. Изучая возможности финансовых рынков, вы обязательно увидите и фразу «фондовый рынок». Все-таки, зачем нужен фондовый рынок и может ли быть полезным простому человеку, который ищет способы дополнительного дохода? Отвечаем на эти вопросы в нашей статье.

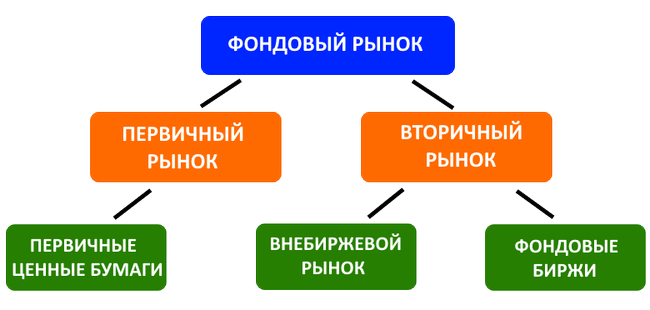

Если говорить в общем, это набор правил и механизмов, позволяющих осуществлять, с помощью норм, торговлю ценными бумагами. Этот рынок подчиняется четким правилам и регламентам, имеет строгую регуляцию и это его отличие от внебиржевой торговли (например, крупнейшие внебиржевые торги проводятся в системе RTS Board (официальный сайт), MOEX (официальный сайт), в США — NASDAQ (официальный сайт)). Внебиржевый рынок — еще один вид рынка ценных бумаг, где проходят сделки с ценными бумагами вне фондовой биржи.

Участниками такого рынка являются разные лица, которые находят друг друга через посредников: крупные инвесторы, финансовые институты, дилеры, которые не хотят проводить сделки официальным способом, то есть через биржу. Также чаще всего вне биржи проходят сделки активами, которые не удовлетворяют правилам допуска к торговле на бирже (которые еще называют биржевой листинг), это в основном активы небольших компаний.

Главное преимущество такой торговли является то, что участникам не нужно придерживаться строгих правил: «торговать можно из любой части планеты в каком угодно объеме акций». Такая торговля выгодна тем участникам, которые не могут провести сделку по разным причинам, например, по причине низкой ликвидности актива на бирже, менее выгодной инвестору.

Внебиржевый рынок отличается отсутствием единого центра, который бы управлял процессом, в том числе и ценообразованием активов, сегодня это сеть дилеров, проводящих сделки через информационные системы. Отличием данных рынков является и порядок ценообразования: на бирже заявки словно «стекаются» в одно место, затем участники рынка сводятся между собой, а на внебиржевом рынке сделки проводятся между клиентом и дилером (который, купив ранее активы, желает реализовать их по лучшей для себя цене); стоимость активов на бирже доступна сразу для всех участников, на неофициальном рынке цена известна только дилеру, совершившему сделку с заинтересованным клиентом.

Однако более распространено определение фондового рынка как места, где через брокеров

и предоставляемый ими функционал проходят сделки трейдеров. Кроме того, фондовый рынок позволяет создать и поддерживать оборот разных бумаг, поэтому его синонимом часто оправданно считают другое определение — «рынок ценных бумаг» (англ. вариант — stock market), например, в Википедии, которое, стоит отметить, является более общим, охватывающим еще и внебиржевые торги.Объединяя совершенно разные стороны со своими интересами, фондовый рынок сегодня выступает одним из привлекательных и доходных инструментов

грамотных инвестиций в активы:тех, кто имеет деньги и хотел бы увеличить их количество и тех, кто хотел бы их заработать,компаний, которые заинтересованы в получении инвестиций со стороны, расширении штата инвесторов и тех, кто имеет деньги и желает выгодно вложить свой капитал (с целью войти в управленческий состав компании, получить стабильный доход от дивидендов),брокеров, предлагающих сервис для комфортной бесперебойной торговли и

инвесторов, желающих выгодно приобрести или реализовать активы — различные ценные бумаги крупнейших организаций (от пищевой промышленности до нефтяных, автомобильных, строительных магнатов).

Этот рынок — наиболее устойчивый при экономической нестабильности. Онделает возможной покупку (продажу) активов для целей: стать частью управленческого состава бизнеса (инвесторы) или получения дохода на разнице от сделок (спекулянты). Век информационных технологий сделал доступной работу с мировыми биржами буквально из дома, а мобильные

устройства предлагают повсеместный доступ к торгам. Современным фондовым биржам, предлагающим услуги торговли акциями, не нужны офисы, вся работа осуществляется в удобной электронной форме.

История развития фондового рынка

Первый прообраз фондовых рынков появился и полноценно функционировал еще в 13-14 в. в виде вексельных ярмарок, на которых торговали векселями (с нем.яз. обмен, размен), — письменными обязательствами, гарантировавшими владельцу получение конкретной суммы. Во Франции с 1304 года изначально это были менялы. В 14 веке государство стало выпускать ценные бумаги, возникли первые биржи. Далее, в 16 веке развитие процесса торговли акциями способствовало повсеместному появлению фондовых бирж. Интересно, что биржа в Брюгге, по Википедии, обслуживающая иностранных инвесторов, в 1592 году первой опубликовала данные о стоимости предлагаемых ею бумаг и именно эта дата с тех пор называется годом рождения всех бирж.

На бурное распространение фондовых рынков повлияло развитие бумаг, повсеместное появление акционерных обществ (Английская, Балтийская, Ост-Индская компании например), которые объединили частные средства для сделок и позволили получать доход владельцам акций. Например, Амстердамская биржа обслуживала акции популярной Ост-Индской компании, допуская наличный расчет в сделках, а также срочные сделки, сформировавшие спекулятивный рынок.

Стоит заметить, что до 19 века было мало акционерных обществ, а оборот их ценных бумаг был еще мал, однако уже в конце столетия большое распространение получила форма собственности с помощью акций, которые стали особенно популярны. Тогда же на биржах были отработаны все процессы торговли акциями, доступные и сегодня: например, на Амстердамской, Нью-Йоркской фондовой бирже, Английской и т.д. Развитие рынка в Австро-Венгрии, США, Германии способствовало появлению специализированных бирж: в Манчестере (железная дорога, текстиль), Ливерпуле (страховые компании), Глазго (судостроение, металлургическая промышленность) и другие.

Это позволило сформироваться биржам-легендам с внушительной историей развития. Амстердамская биржа, которая работает с 1611 г., сегодня является старейшим международным рынком акций. В Америке в 1792 году возникла фондовая биржа NYSE (Википедия), которая поспособствовала возникновению империй магнатов Рокфеллер (Википедия), Морган (Википедия), например. До 1917 года в России также существовал рынок акций, облигаций, развитие которого в период революций было приостановлено и только после 1990-х г. вновь возобновилось распространение бирж, которое очень динамично происходит в наши дни. Благодаря повсеместному внедрению интернета рынок развивается прямо на наших глазах.

Более подробный обзор фондового рынка предлагаем в следующей статье.