Oscillators for Binary Options

Binary options – something that is constantly being talked about is a field of activity that is controversial, but it is even more attractive because of its advantages: its accessibility, ease of operation, small start-up money, and the possibility to work without an initial deposit. This market, although it attracts Internet users by its possibilities, can also repel by the amount of knowledge, which will be needed to significantly increase the size of the deposit.

Contents

- 1 What are “oscillators”?

- 2 When did oscillators appear?

- 3 Types of oscillators

- 4 What are oscillators for binary options?

- 5 How is a deal formed on the binary options market?

- 6 How is a deal formed on forex?

- 7 Platforms with oscillators for binary options

- 8 How are the indicators used in the broker’s terminal?

- 9 What to do if the platform does not have the necessary oscillators?

- 10 How to add an oscillator to the MetaTrader 5 chart?

- 11 How to get signals based on the oscillator?

- 12 Binary options oscillators

When starting to work here, it is worth remembering at the very least that trading at random is not the answer and that such an approach will only lead to losses and disappointment in this area of online earning. Experienced players and those traders who are determined to seriously interact with it, try to undergo full-fledged training, including a training account, participate in competitions, study useful literature – in short, do everything to feel more confident on the real market (Binary options trading training).

One of its advantages is the ability to work with serious tools to help you make the right decision to enter a position and finish your trades with profits. This is Indicators for Binary Options and oscillators. These two groups of tools belong to the technical methods of analyzing the dynamics of assets, quite available on the Internet, including on the trading floors of the modern binary brokers. In this article we will talk in detail about oscillators, designed to determine in advance the mood of the market and make the right positions to increase income in the account.

What are “oscillators”?

Such tools (from Latin oscillare – oscillate) are commonly referred to as parameters, programs used in the course of technical analysis of the asset mood and study of the market situation. Or in another way, they are a type of graphical indicators which instantly identify the state of the object observed by the trader, which determine to which stage it belongs – oversold or overbought. In addition, oscillators are used in divergence situations (convergence/divergence).

Most often, such tools are placed directly under the chart of the asset in a separate window, which makes it convenient and easy to work with their data. Among such tools we would like to mention the one that every trader is familiar with Stochastic – is one of the first such indicators, which perfectly copes with the role of reliable signal search. An important advantage of oscillators is that they act ahead of time, providing valuable information to the trader in advance and this becomes a strong secret of success for players, which, of course, allows them to “win” during trading: to place the right deal and get a decent income from options trading.

The market is characterized by a change of trend: it is a flat or trend. If the same-name instruments work with trends, it is oscillators that are indispensable for the flat market. strategies traders, they provide advance information about the dynamics of the asset. By analyzing the information of oversold and oversold, they find the moments of maximum or minimum, which indicate the weak dynamics of the asset or the desire of the asset to make a turn in the other direction. Thus, this group of market analysis tools will be useful when working in a relatively calm market condition. It will also be indispensable for beginners who need to pinpoint the “bullish” and “bearish” moods. In this case it is accepted to act according to the rule, according to which if the instrument is located at the very top of the window, it is an ascending, ascending mood; if it is located at the lowest points of the window, we should talk about the descending, descending mood of the asset.

Top 5 best binary options brokers: test their terminals

| Broker | Bonuses | Open an account |

|---|---|---|

|

1

|

50 %

Bonus on deposit from $100 USD – promo code WELCOME50

|

Start |

|

2

|

5 %

Bonus when depositing via USDT (TRC20)

|

Start |

|

3

|

Cashback

Refunds of commissions, spreads and other costs

|

Start |

|

4

|

15 %

Bonus 15% on deposit by promo code iCGSbEgiAR

|

Start |

|

5

|

100 %

First deposit bonus

|

Start |

When did oscillators appear?

Such automatic tools, or you can even call them “machines”, were not always “at the trader’s fingertips”. Initially investors, speculators and gamblers had to make all calculations and draw charts themselves – this, of course, complicated the already complex trader’s work. With the advent of computers, everything became easier – the first indicators and oscillators appeared, which took upon themselves the difficult work of calculating information about the market. Now the trader has only to analyze the already existing data. The first oscillators which appeared in the middle of the 20th century were Duffing’s oscillator with a simple mechanism of work, then more complicated Stochastic appeared, RSI, Ishimoku, MACD, Chaikin oscillator, McClellan oscillator etc.

Today every home has a computer and the Internet, which allowed the development of trading further – now it is easy to find the tool you need and install it in your platform; now it is easy to register with a broker, open his terminal and use the tools, which are available here. The development of internet and technology allowed a fast development of trading and made options available to anyone. Today, there are dozens of different oscillators available to the trader, and one can find any of them and incorporate them in one’s own market strategy.

Types of oscillators

Thanks to the development of the Internet and technology today offers a lot of such tools and all of them in one way or another, depending on the task is useful to the player. But how not to make a mistake when choosing an oscillator and to use exactly that tool in your case? This can be helped by the knowledge of oscillator classification and we will discuss it in the next part of our article. All such tools can be divided, depending on their functionality, into

- Those that measure the trend

These are tools that help the trader in determining the trend, i.e. strength, direction and duration. These are, for example, trend tools such as MACD or ADX etc.

- Those that measure the level of volatility

These are instruments that measure a measure of the variability of asset values relative to the average or previous value. These are, for example, tools such as the Average True Range or Chaikin’s Volatility.

- Those oscillators that measure the rate of value

They are also called speed instruments and their peculiarity is that they are used to determine the rate of price dynamics over a period of time. There are a lot of such instruments, such as RSI, Commodity Channel Index, Momentum, Stochastic, Williams` %Range (%R), etc.

- Those that measure indicators of transaction volumes

They are also commonly referred to as volume, and their advantage is that they measure trade volumes. They include, for example, Volume Oscillator, On Balance Volume.

- Those oscillators that measure cycle rates

They are also called cyclic and have the advantage that they can be used to define cycles. For example, the MESA Sine Wave Indicator or the Fibonacci Time Zones.

What are oscillators for binary options?

The question of why the options market is so attractive is both simple and complex. Of course, it impresses by the opportunities that are available here. In addition, working here, players themselves influence the amount of profits, they can do everything in order to get the desired result. To do this, they improve their experience, work on binary options demo accountThe main reason for this is that they are not able to enter the contest, which offers them attractive prizes, including cash prizes.

Besides, they pay much attention to studying and testing indicators and oscillators – those technical instruments which, by analyzing the market according to their internal mechanisms, provide data on the dynamics of assets, predict in advance their direction and allow to make bets to the UP or DOWN. Such oscillators, though less present on the options market, are actively used by the players. Thus, RSI, Stochastic are popular among beginners, Momentum, MACD, CCI etc. They can be used in binary options trading and, if you work with them correctly, you can achieve decent results.

The difference between options oscillators and oscillators for forex

Is there any difference between oscillators and such instruments of other markets, for example, forex?

When answering this question, it is worth understanding that options have not long been offered as a separate market with its own opportunities and laws. They are interesting, first of all, due to a number of advantages: decent profitability, a more simplified trading method than in other markets (because in order to get your profit after, say, 60 seconds, you only need to specify the direction of quotations: down or up).

There are different financial markets. The same tools and types of analysis are used here, depending on the investor’s objectives. This also applies to the forex market, securities market etc. Moreover, indicators and oscillators were originally used exactly in forex, from where they came to binary options, which appeared much later. So, both simple and complex oscillators were used in options, as well as popular and proprietary tools. Here, the options market differs from the forex market. Thus, it offers a fixed duration of the bets (Binary Options Expiration), you only need to determine the direction of the dynamics of assets to make a profit.

In forex, everything is more complicated: here, the players, trading assets, must monitor how many points the direction of the quotation moves and this affects how much profit they get as a result of the work, which in options, by contrast, is fixed and the players know in advance what profit they will receive in case of correctly guessed dynamics of the asset (The whole truth about forex). Also, in Forex it is possible to keep an open bet for as long as the trader considers necessary, and this can lead to both decent earnings and large expenses. In the case of the options market everything is simpler: the trader, knowing what income is waiting for him, will receive it as soon as the quote has moved at least one point in the right direction.

When placing a trade on Forex, the trader must specify more parameters, must use and know more concepts than, for example, when working with options. With forex it is important to understand what are swaps, spreads, leverage, differences between orders, etc. With the options, everything is much easier, and we can even say that they appeared as a separate market, so they absorbed the maximum of useful options of Forex market: they are more technological and understandable, but became more convenient, easier, comfortable and have less risk. In many respects the specifics of work are the same, the same instruments are used, it is possible, for example, to trade on the scalping, Martingale, work with long-term assets, etc. Both of these markets have similarities, but there are differences in working with them. For example, in order to start trading on Forex you will need to make more adjustments, you need to know more about the work. For example, in order to limit losses here it is necessary to correctly use stop-losses, take-profits. Let’s show it on examples below.

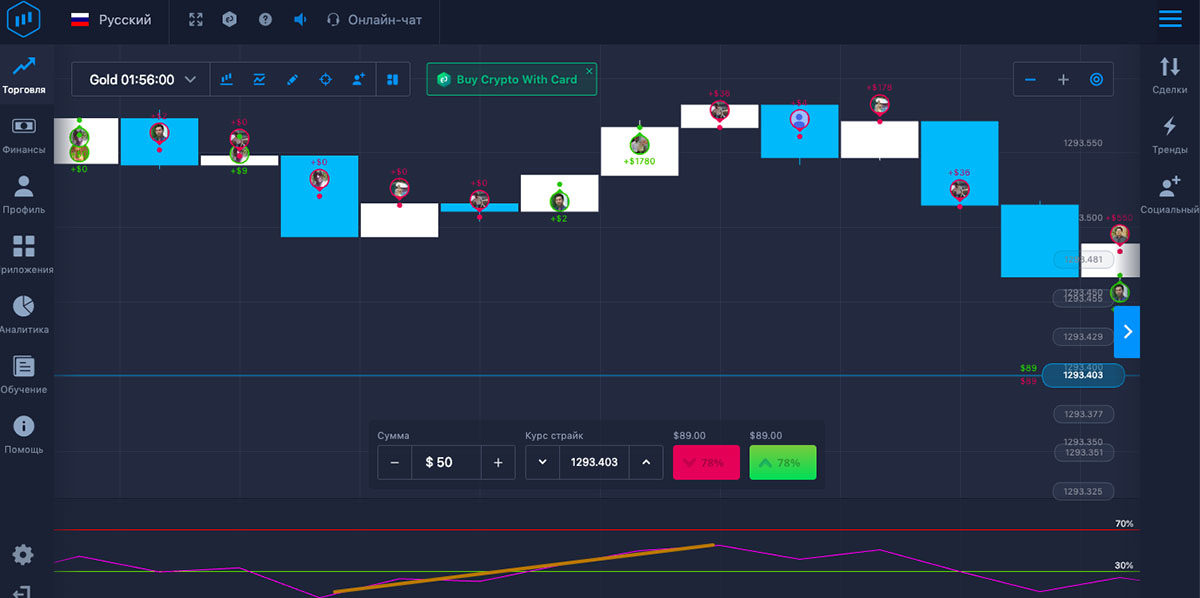

How is a deal formed on the binary options market?

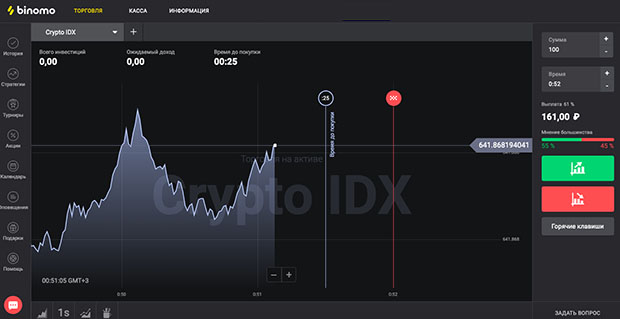

It is very simple and it is due to its simplicity that options instantly gained such popularity. Here, in order to start trading, you need to log in to the platform of a brokerage organization, for example, INTRADE.BAR, and perform the following steps:

- Choose an asset among the offered instruments,

- Choose an expiration,

- Specify the amount of investment,

- Press one of the buttons (up or down) to specify a prediction of the dynamics of the quote.

In addition, the trader sees the size of his income (and losses, respectively) in the system in advance:

How is a deal formed on forex?

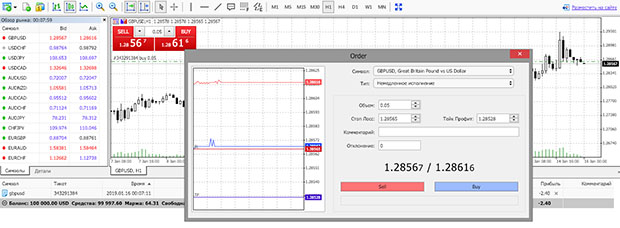

In the case of forex, everything is somewhat more complicated and this market is not as simple as options – in order to enter the trade and place a bet, you need to make more adjustments. To start, the player enters the platform of a brokerage organization, such as the Metatrader 5 terminal, and perform a number of actions:

- Select the type of asset,

- Specify the amount of investment

- Type of execution

- Stop Loss Parameters,

- Take Profit Parameters,

- Deviation parameters, comments.

When trading forex, players do not see in advance the amount of profit, which here is not limited by the framework of the system, but with this approach and the risks are also much higher than in binary options, where both of these indicators are fixed:

Platforms with oscillators for binary options

The options market, which is dynamically developing recently, offers a large number of trading programs with different features. Therefore, it is fair and relevant to consider the difficult question of how to choose among this variety of terminals that will suit the trader and make his stay on the market both comfortable and functional. Such programs are a special software solution that allows the trader to start trading at any convenient time, work with a personal account, schedule – to keep track of all the necessary options for modern trading. There are a lot of such programs, all of them, despite a number of similarities, have differences in features, availability of any options and tools.

In order to explore these possibilities of such a program, it is customary to register a demo account and study the platform “in practice” – during the training trade with virtual capital. Here players are confronted with the concepts of “authoring platform” and “development of special organizations”. Which platform is more profitable? Where is better to trade? We will try to answer these questions in our material.

Author’s terminals with oscillators

Such programs are developed by the brokerage organizations themselves. In the market the author’s platforms are offered by Binary, Binomo (bonus 100% to deposit by promo code REVIEWEEK100 – Activate), ExpertOption, etc. It is generally accepted that the presence of such a platform in an organization confirms its serious intentions to work in this area, that it is interested in providing a unique and convenient service for clients. The advantage of such software development programs is that they are designed to simplify the work, to remove all unnecessary functionality and leave those solutions that he really needs. In addition, innovative options, convenient windows, personal accounts, types of expirations, etc. can be implemented here.

- INTRADE.BAR (site)

All clients cooperating with this brokerage organization are offered a unique software solution, which has no analogues on the market. This trading program is convenient, focused on comfortable work with option contracts, including for beginners. The platform has a large set of useful options: chart types, types of expirations, different assets, graphical elements, and a variety of oscillators: for example, Momentum, RSI, MACD, Ishimoku, Stochastic. By adding just a few clicks to the chart with one of these tools, you can customize it and work with absolutely any strategies.

This company also offers its clients an author’s platform, unique, simple and convenient. It’s easy to understand the features of the system, you can study the market opportunities and get involved in trading, quickly executing transactions even if the client just starts his first steps in option trading. You can change assets, expiry types, chart types, add graphical elements, oscillators like RSI, Stochastic, CCI, MACD, etc.

The author’s platform of this company is convenient, functional, contains a lot of interesting options (changing the type of workspace, visualization of “social trading” option on the chart, etc.), laconic design. This unique program is easy to learn and will be comfortable for beginners as well. In addition to an intuitive interface it has the ability to select assets, change the chart type, work with graphical tools, oscillators, such as the MACD, Fractal, RSI. In addition, you can load your own tools here, which expands the opportunities for traders.

Standard terminals with indicators

On the market there are also brokerage companies that offer their clients to work with platforms that have been developed by third-party companies specializing in creating such trading solutions. Such programs can be found in both experienced and young brokers, so one should not assume that if a company does not have its own terminal, it is inferior to its competitors. No, that’s not quite right, because for such a decision it’s necessary to study in details the organization’s activity, clients’ reviews, and its license.

In fact, such standard solutions are even in demand in the market, because, having started working in one platform, they would like to continue cooperation with the broker, but in the software solution that they already know – it is both reliable and, of course, affects the trading results. In many ways, the popularity of such platforms is also due to the fact that their functionality is more advanced than that of brokerage programs, which also attracts players. This is true, for example, for MetaTrader 4 and MetaTrader 5. Tradologic is also in great demand, TradingView and TradeSmarter. Let’s talk about them in more detail below.

- MetaTrader 4

This is probably the most popular program of its kind for advanced trading. It is rightly called legendary, reliable, simple. Today, there are no players who haven’t heard of it – all thanks to its powerful functionality, large set of various options, ease of use and clarity. After opening the program, you can “in no time” organize a trading space for a player with any experience in trading – both for beginners and professionals. In MT4 you can use a large set of tools, oscillators (for example, Stochastic, RSI, Momentum, MACD, Volumes, ATR, Zigzag etc.), types of trades, charts, expirations, history of their trades, etc.

In addition, you can download additional tools and trading systems, conduct any strategies, auto-trade, work in the MetaEditor to create your own oscillators. All this makes the program almost limitless for any wishes of investors, who will be able to implement any trading techniques. This powerful program is offered today to its clients by a large number of brokers, for example, Yardoption, Grand Capital, Larson Holz, InstaForex, World Forex, Alpari.

- MetaTrader 5

Acting as an updated solution of the previous software product, this program offers the player even more unique options. It retains the functionality of the previous solution, but offers even more features, which, of course, instantly made it popular with investors. In MT5 it is possible to work with options and other markets (forex, security prices, etc.), analyze the market, trade using different strategies, including scalping, invest in long-term assets, etc.

It also offers a large set of oscillators, the number of which can be expanded by adding new instruments to the program. About 80 instruments are built into the program initially, and at the same time, there is a “Market” available where you can buy or download oscillators and indicators for free. In addition, knowing MQL5 language, players can also create authoring scripts. This powerful trading solution is available, for example, from companies Corsa Capital, Alpari, etc.

- TradeSmarter

Also an interesting program offered by a number of brokerage organizations to clients. It is in demand primarily among professional investors. The program is functional and easy to learn and work with. As its advantages, which allowed to include it among the best similar products, it is worth noting its increased attention to safety and reliability of work, opportunities for the analysis of assets, work with charts, the choice of instruments. The terminal is laconic and has a dark design that allows you to concentrate only on your work. Even a beginner will be able to learn it quickly.

One of the brokers offering trades in this program is Finmax – a young but ambitious organization, which has achieved a positive reputation ahead of time, constantly occupying leading positions in the ratings. Much of the reason for its instant success is that it offers trading in TradeSmarter. Here, although it is a perfect solution for working on the market, there is still a drawback – very few tools for market analysis (say, oscillators: MACD, RSI).

- TradingView

Every self-respecting trader should know about this “live chart” and indeed players take it to use its advanced capabilities for their own purposes. Here it is possible to implement any trading techniques and strategies, to study the market, using a huge toolkit (these are both graphical tools and oscillators). The program is easy to master, convenient, works without failures and can offer to players a set of tools, including author’s developments. When you start here, you can customize the background of the program, select assets, oscillators (there are both free and paid instruments), use the chat. Note that brokers often offer this program for their clients, for example INTRADE.BAR, Binary, Migesco etc.).

How are the indicators used in the broker’s terminal?

- INTRADE.BAR

In his terminal, it’s easy to get acquainted with the oscillators available here – they are located in the lower part of the program, in the same place where the settings of expiration and chart type occur:

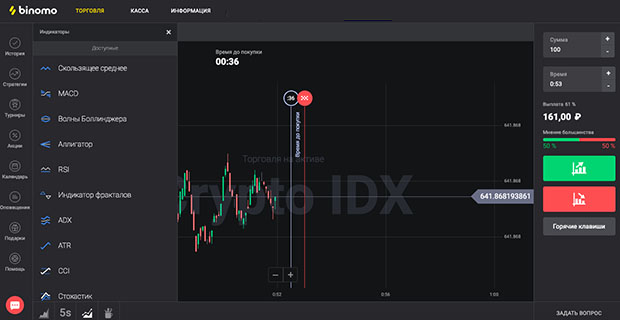

By clicking the “Indicators” button, you can explore the available tools:

Selecting any of the oscillators, you can immediately perform its settings in order to work comfortably with it. After that it is only necessary to add it to the workspace, using the “Build” button. This will make the chart look like this:

- Binarium

In the trading platform of this company it is also easy and simple to work with oscillators, which are located here on the bottom toolbar:

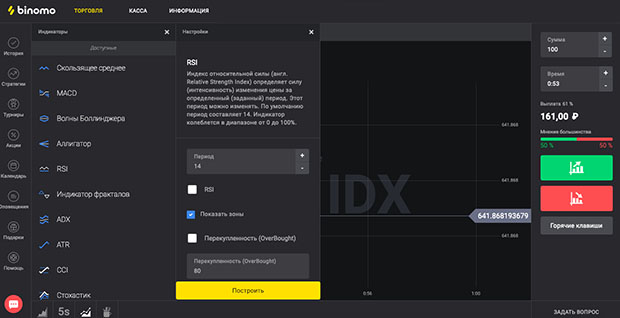

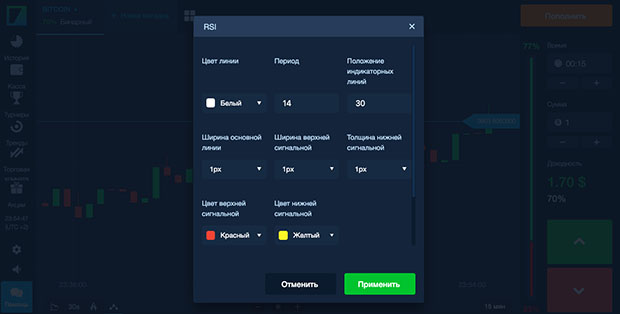

Selecting one of the available oscillators here, you are offered to make its settings immediately:

Then you only have to use the “Apply” button to add the tool to the chart and start working. In this case, the workspace of the platform looks like this:

- ExpertOption

How does it work in this platform? It’s as simple as that. In order to explore the oscillators available here, you can use the button located for convenience in its workspace:

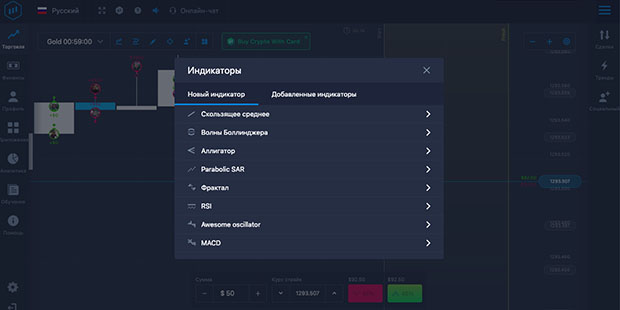

By clicking on the “Indicators” button, you can explore all the tools offered here, including oscillators:

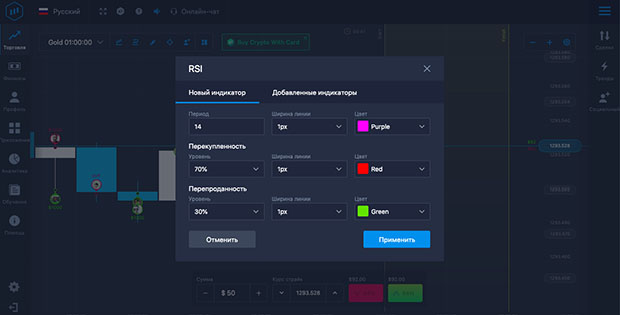

Selecting any of the tools here, you can immediately perform its settings and add it to the chart using the “Indicators” button:

In this case, the graph takes the following form:

- Finmax

This platform also has the option of adding market analysis tools. They are located immediately in the main part of the workspace and by clicking on the “Indicators” button, you can select one of the tools and attach it to the chart:

The graph now takes the following form:

What to do if the platform does not have the necessary oscillators?

This is, in fact, a common problem that any trader faces today. Often, when using some strategies, he realizes that not all the tools are available in his broker’s platform. What to do? What all market players do is to work in standard platforms, which contain a maximum of instruments. These are, for example, “live chart”, Metatrader 4 (or MT5). These powerful platforms have a large number of instruments, and to the MT4 and MT5 terminals you can also add new oscillators, which significantly expands the players’ possibilities. But even here it is worth remembering about one “but”. Metatrader terminals use quotes from certain liquidity providers: Currenex, LMAX Exchange, FXCM Pro, Integral, Hotspot FX, Alpari, Swissquote, FastMatch. Therefore, you need a broker that works with the same organizations to work here.

How to add an oscillator to the MetaTrader 5 chart?

- 1 way. Through the library.

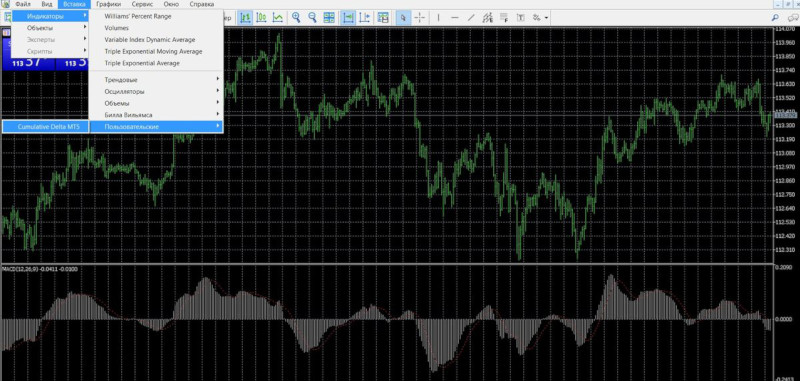

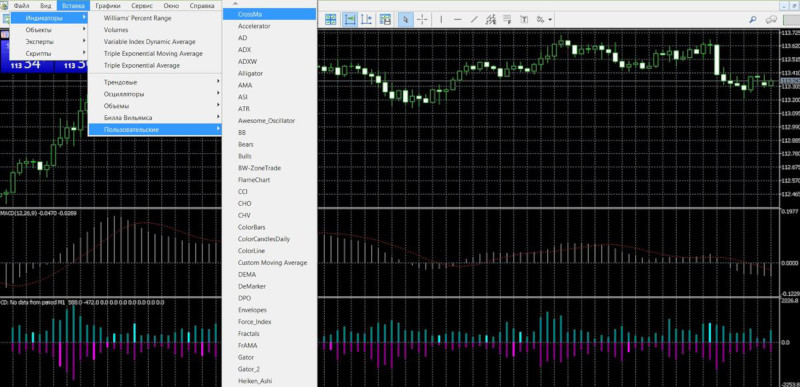

When starting to work with oscillators in this platform, it is worth checking whether any of the necessary tools are available in the program itself, because after installing it, the trader has a number of oscillators already installed. To do so, it is worth using the sections “Oscillators” (as well as Volumes, B. Williams, Custom):

After selecting the desired tool, you can immediately add it to the chart and make its settings. If it does not appear in these sections, it is worth using other features of the program:

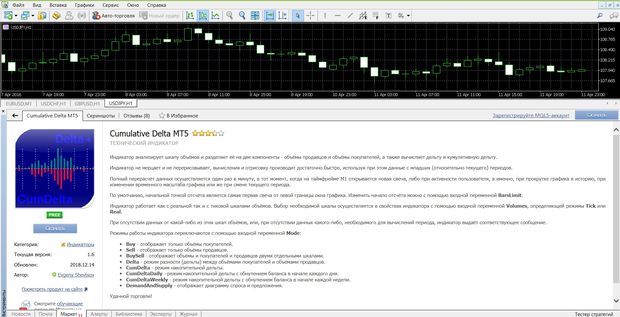

- 2 way. Via Market.

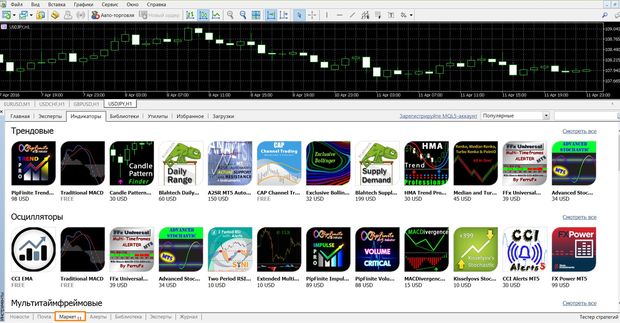

This section is available at the very bottom of the program and offers a number of interesting features to the player. Here you can download both paid and free programs and study information about them. The advantage of this solution is that you don’t have to search for tool files on the net and worry about whether the file is the right one, whether it will work correctly, or whether it contains dangerous or affiliate content.

You can immediately download any of the tools and read their descriptions:

The tools are immediately displayed in the “Custom” folder and are available for work:

- 3 way. Through the Internet.

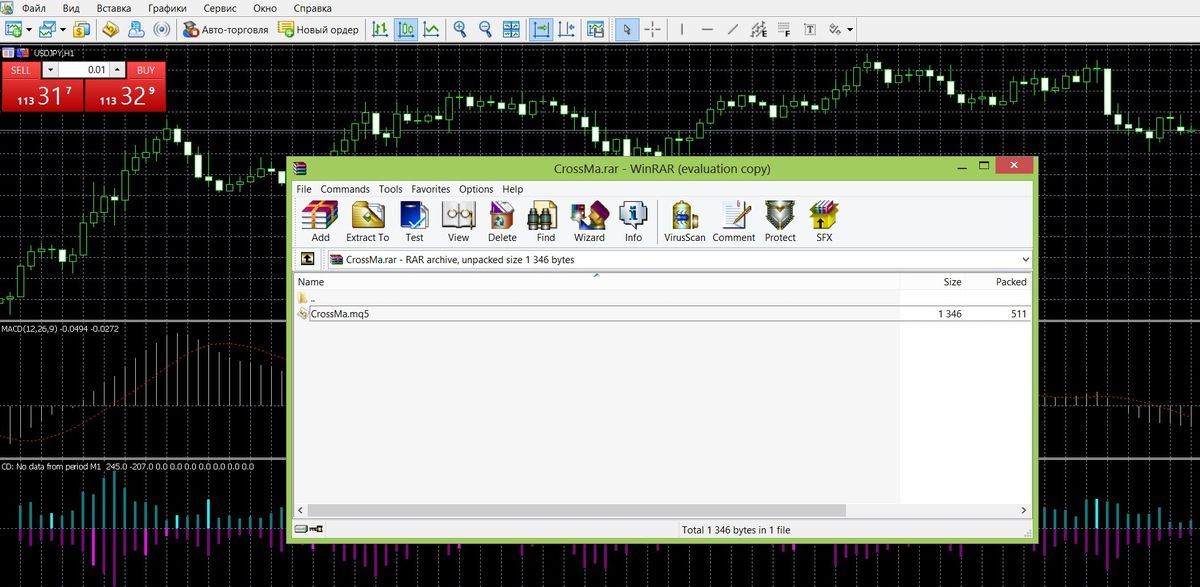

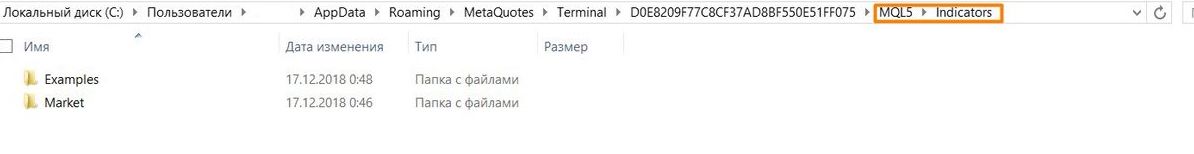

This method is also popular with players, as there may not be any tool for a particular strategy in the Market. In this case, you have to use the Internet and download the files in the familiar way for traders – in the program directory:

Having found a file in the “mq5” (“ex5”) format, you can begin further work:

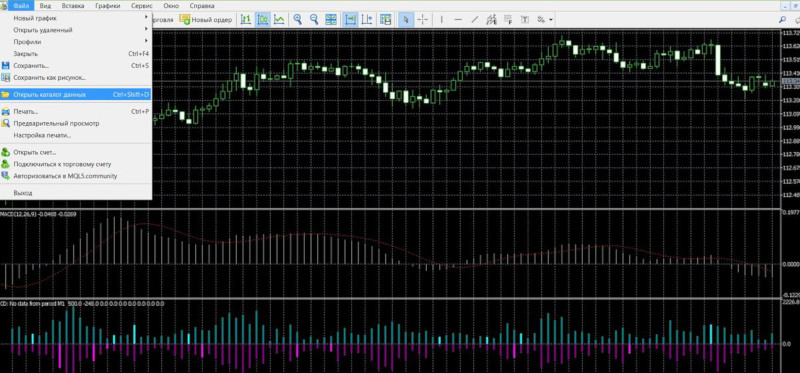

After downloading it, you should open the program’s data directory:

Then, open the folder MQL5 – Indicators:

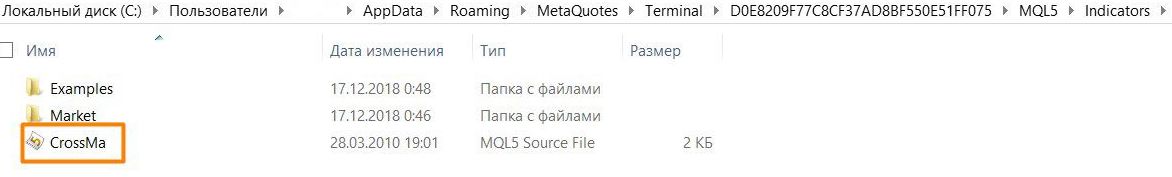

The oscillator file is copied to the last folder:

That’s it. It is added to the program. It remains to restart it (close and reopen it), check the availability of the tool in the “Custom” menu item:

If everything is OK, you can click on the tool and add it to the graphic to work with it later:

How to get signals based on the oscillator?

Finding signals for working in the market is one of the main problems for traders, because it is their quality and accuracy that determines the productivity of their work. The oscillators themselves can be their source, as well as the entire trading techniques provided by individual companies and brokerage organizations. Using the example of the Expertoption platform, let us see how signals are searched for using RSI.

RSI – one of the most common tools for players, which is simple and easy to use, allows you to get information about the overbought / oversold signals, divergence.

How to trade options with RSI in the Expertoption platform

- At overbought/oversold:

If the RSI is near the 70 indicator, an overbought zone (downward sentiment), you can purchase PUT options:

If the RSI is near the 30, the oversold zone (upside), you can buy Koll options:

- Discrepancy:

In the case of divergence, the rising price sentiment is not confirmed by the RSI, you should make a contract with the value to the UP:

In the case of convergence, the falling value sentiment is not confirmed by the RSI, you should execute a contract with the value DOWN:

Binary options oscillators

Trending

- MACD (convergence/divergence sliding)

This tool is notable because, by showing the difference between the slips, it allows you to use a number of accurate data about the current market sentiment and increase your advantages during the work. Like all oscillators, it, when added to the chart, is displayed in a separate window, which is convenient. This is one of the popular tools that appeared in forex and options quite a long time ago, it is valued because of its flexibility and apparent simplicity. When interpreting its data it is customary to rely on the following logic: when its red line crosses the blue muving, it is a rising sentiment, when it is the opposite – it is a falling sentiment. The green bars are also a tool to work with: they allow us to draw conclusions about the trend, whether it is strong or not, and what the general mood of the market will be.

- ADX (average directional movement index)

This tool will also be useful in the work of market players. Its value is in accurately determining market sentiment, as well as capturing changes in that sentiment, strength, and volatility levels, which is why it is often found in strategies where it shows accurate data. It consists of three lines: +DI (which is a positive sentiment muving, usually blue), -DI (which is a negative sentiment muving, usually red), the ADX itself, which shows the main direction of the market mood or lack thereof. It is customary to use it in the following way: if its index shows growth, this means an increase in sentiment; if it falls, it means a decrease in sentiment; if there is a strong divergence between the +DI and -DI moving average, then one can conclude that sentiment is growing and vice versa that it is weakening.

- RSI

This tool can be confidently considered one of the most important for players, regardless of their experience, performance and strategy. It is particularly useful: it allows you to know exactly the peculiarities of changes in the indicators of asset dynamics relative to their previous data. It is included in the work when it is necessary to learn about the mood of the market, overbought and oversold, reversals and the emergence of new trends. It is also, when added to the main workspace, is located in a separate window, which is especially convenient for players. When it rises above 70, we are talking about overbought assets, when it is below 30, we are talking about oversold assets, when the mouwing oscillates between 70 and 30, we are in a flat.

- Ishimoku

Also one of the interesting and effective tools actively used by players in their work. This real “Japanese miracle” consists of several lines, the combination of which will allow to observe the market sentiment, timely enter into trading and significantly increase your account. The reason for its great popularity is its simplicity, the ease of working with it, but at the same time it offers a lot of information that would be useful for the trader, which would allow, using only its data, a powerful tool that can provide all the necessary data about the mood of assets (trends, support and resistance data, pullbacks, data about exiting or entering a position).

It can safely be considered an entire trading system, yet simple and understandable. Despite the fact that it consists of five lines, which may seem complicated and illogical, here everything is simple, on the contrary, we should consider it a logical and understandable tool that generates clear signals. It is efficient and effective, due to the fact that it is a separate powerful system, it is actively used by players.

Volatility Oscillators

- Chaikin Indicator

One of the brightest instruments of this group, which is very popular with players. Its distinctive features are in its simplicity and convenience. In its work, it relies on the data on the difference between the maximum and minimum values. And even though it cannot track gaps, in any case, it is a tool that should be a part of a strategy of a serious player, especially if he prefers to trade short-term assets. Thanks to its easy-to-use principle and accurate signals, it will also be an assistant to a beginner. It is able to generate information about volatility, reversals, terminations and changes in market sentiment. It is recommended to include it in the strategy and use trend tools to confirm its information.

- Average True Range

It is also considered one of the common tools of this group. It is popular with players in different markets due to its ease of operation and clear generated data, and is often found in trading techniques. Like other oscillators, it is located in a separate chart window. It has the particular advantage of identifying the moments of the greatest peaks in the variability of moods, which can be actively used during trading. It will be a real assistant to players, not only to determine the exact level of volatility, but also to find data about the future dynamics of the value, while reducing unnecessary noise that would complicate the work. Thus, it is usually interpreted in such a way that if its values are high, we are talking about increasing sentiment, and vice versa, the lower the ATR values, the weaker the sentiment.

It is also a tool that deserves the attention of players because it is easy to work with, but offers them those data about the market that, if used correctly, can improve performance. Its other name is the “vigor index. It is commonly used not only as an ordinary oscillator, but also as a trend-following tool for determining asset conditions. It is customary to use it as a filter with other instruments, such as the RSI. It can confirm the RSI data: for instance, if the RSI is above 70, it will soon reverse, and you can get ready to buy DOWN options, and if it is near 30, you can buy UP contracts. It can also be used to look for oversold and overbought zones, as well as divergence and convergence moments, which are also strong indicators of a change in market sentiment.

Price velocity oscillators

- Stochastic

There is probably no player, even among beginners, who does not know about this tool or has not heard about it. It is one of the most popular tools, which is the first thing that players get acquainted with when they start their way in this or that market. Of course, all of this is only possible because of its advantages – its simplicity, as well as the clarity of the data it generates. This is the main working tool that can provide the trader with a lot of data: current moods, extremes, reversals and entry/exit points. It can be used with different assets, different trading methods.

In many respects, analyzing the peculiarities of the velocity of the value, it resembles the RSI, but it is much more dynamic than this tool, more often located in the zones of extremums. For example, it is customary to use it to determine the extremums: when it is overbought (above 80), we should expect a reversal, and therefore we should get ready for the execution of PUT contracts; when it is oversold (below 20), we should get ready for the execution of KOLL contracts. In the case of discrepancies, when the instrument data is not confirmed by the value data, it is also worth looking for moments for market reversal.

- Commodity Channel Index

This tool is quite familiar to market players and is found in various methods and trading systems. Like other oscillators, it is indispensable for finding zones of extremes. In many ways, it also resembles the RSI. Its line is located within the -100 and +100 levels and, moving out of those levels, it exhibits over-sold and over-bought signals, which are the main characteristics of this instrument. But it is still more effective as a filter. Usually, using its data, the players act as follows: if the line is located below -100, it means that the mood is about to go up, and it is worth to open contracts upward; if it is, on the contrary, located above +100, it means that the reversal is coming and it is worth to open contracts downward. Also its capabilities are widely used in determining the convergence/divergence zones.

Volume oscillators

- Volume Oscillator

Instruments of this group track trends in the dynamics of trading volume. For example, the Volume Oscillator consists of two lines, the behavior of which shows this information: if the fast line is above the slow one and the instrument is above the 0 mark, then we are talking about a rising sentiment; if everything is the opposite, then we have a falling sentiment. This information allows us to judge about the current trend and use it to increase our possibilities. It is also customary to use the signals of the crossing of the line 0, when the following logic is applied: when crossing from down to up it is worth buying options UP, when crossing this mark downwards it is worth to make a deal DOWN.

- On Balance Volume

This tool can be used as a trend tool, but the calculation of its data takes into account the data on trading volumes – a serious indicator of the strength and nature of the sentiment of market participants. Its significant advantage is the anticipatory nature of the data, which will be a serious advantage for players who use it in their strategy. It is also important to note that it is very simple and straightforward to work with, but generates accurate data that will lead the player to increase his deposit. It is also located in a separate window, as well as other similar tools that show data on asset trading volumes. OBV is used when looking for a range of data: it includes breakdowns, extrema, reversals and confirmation of market sentiment.

Cyclic oscillators

- MESA Sine Wave Indicator

This tool would be an excellent source for collecting data on market cycles and features that allow you to judge the presence of certain forces. It can be actively used not only in trends but also in the absence of trends, where it is difficult to see any dominant forces. The advantage of the tool is the easy principle of work, even beginners will be able to cope with it. Using its data, you can see the exact data and, having made the right decision about the dynamics of the asset, positively influence the account size.

- Fibonacci Time Zones

This tool looks like a series of vertical lines on a chart, based on the use of a sequence of Fibonacci numbers. It serves to determine future reversal zones, data on the continuation of sentiment. Here we work not with the indicators of the dynamics of the value, but with the data of the duration of the parameter of the period, which passed after the end of the trend. It is worth remembering that when working with it, we will need one of the trend tools, which would confirm its data. The points of extremums, which the player marks when adding the tool to the chart, are important here: the initial and the final, they will set the length of the interval.