The Rate of Prices for Forex: Fiction and Reality?

An exchange is a place where sellers of assets meet buyers. Demand and supply are displayed through a tool called the Depth of Market and it is actively used in stock trading. But is the Depth of Market used on the Forex and if yes, how to trade in Forex with this tool?

Contents

Exchange glass

Depth of market”, Depth of market, Level II Quotex, Orderbook and so on are the main and obligatory tool in the trading terminals of almost all brokers.

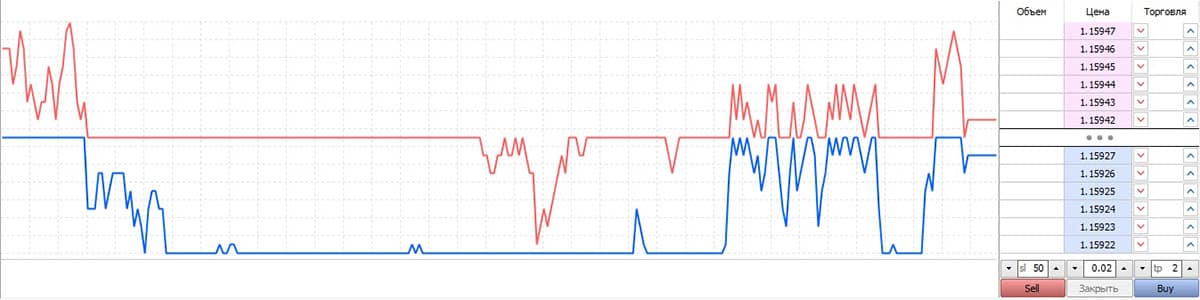

Image. 1

Externally the order books are similar, the differences are not great, since the principle of formation of the table is the same, having understood what the table of orders shows on one trading platform, there will be no problems with it on any other. In the table the requests (orders) are located, on one side for sale, on the other – for purchase, in the order of their receipt from the participants of trades. The number of lots offered at this price is indicated next to the price. In most trading terminals, sell orders are placed at the top of the table and are marked in red. Such orders may also be called “ask”, from the word “ask” – demand. Orders to buy are placed at the bottom in this case and marked in green, they are also called “bids”, from “bid”, “bid” – supply. They also can be called offers, from “offer” – offer, but more often both types of orders are called offers (The whole truth about forex).

Top 3 best forex brokers: test their terminals

| Broker | Bonuses | Open an account |

|---|---|---|

|

1

|

50 %

Bonus on deposit from $100 USD – promo code WELCOME50

|

Start |

|

2

|

From 25 To 60 %

Deposit increase for the first deposit

|

Start |

|

3

|

Cashback

Refunds of commissions, spreads and other costs

|

Start |

|

4

|

100 USD

Loyalty program remuneration

|

Start |

|

5

|

20 %

Bonus and cashback by promo code revieweek23

|

Start |

Brokers are most often limited to a depth of 20×20, i.e. they place 20 actual, so-called “best” sell and buy prices each. But there are also less deep tables of orders, or you can ask the broker for a high queue of quotes online – this is necessary, for example, when trading futures. For liquid assets, new orders appear almost every second. But there are also sparse Deposits of prices, – when we can see the low density of requests in the book of orders, and some prices are simply absent. This means that the Depth of Market actually shows the actual liquidity of a certain asset. Based on the movements in the order book, an experienced trader can estimate the supply and demand, determine the investment attractiveness of an asset, confidently predict the dynamics of the security price (Forex Trading Training).

The list of orders is especially important for traders who engage in scalping – opening and closing transactions at very short notice in order to make money on small price movements in very short intervals of time. Such traders do not have time to build a trading strategy by indicators, on the chart, they have to react quickly to the slightest price changes in real time, which provides an order book.

How do I read the price glass?

You can see two types of bids in the stock market, which are called aggressive and passive. Passive ones show the base value of the asset, and change very slowly over time. Aggressive bids, on the contrary, suddenly appear and move the prices in one direction, forming a distinct trend. By the ratio of these bids, the market situation and the prospects for a particular asset can be determined. The trader can determine the trading volume of the asset, determine the optimum price for purchase or sale, and decide on his bids. Based on this information and his goals, the trader can make his order:

- Market. It is equal to some value between the maximum buy price and minimum sell price. In this case, the bid appears in the order book and the trader waits for it to be executed – that is, when a buyer or seller is found who is ready to buy or sell the asset at the offered price.

- Limit. It corresponds to the seller’s value when buying or the buyer’s value when selling, is executed instantly and in stock market is not displayed. In this case, the trader does not need to assess the situation in the order book at all – the trading terminals have a function to sell by market price.

There are also conditional orders, that is, they are placed with certain conditions, which are set by the trader, and are executed after the fulfillment of these conditions. The Exchange glass shows limit orders. Orders that are placed at market prices are not visible, as they are executed instantly.

- Conditional orders – are orders that are executed upon the occurrence of certain conditions, then they become limit orders or market orders.

- Large requests. Orders for amounts much larger than all other orders in the stack. Their appearance can move asset prices in a certain direction, form new support or resistance lines, initiate a trend, change the market character.

- Iceberg Applications. Often appear after large orders to prevent them from changing the trend. These are repetitive, relatively small orders and are placed by the same traders.

- Recurring requests – is a large order broken into several parts. The sale or purchase of such bids is carried out by periods. The point is to gain a position, to shift the market, but to do it smoothly and little noticeably.

- Pulses – is the growth of bids on the price, with small drops. This type of bids is determined by a large density of bids for sale, which few, who redeem.

Based on the activity in the list of orders, you can fairly accurately predict price changes in the short timeframe, but nothing can be said about the price dynamics in the medium or even more so in the long term. On long timeframes, it is necessary to pay attention to large orders. There is no precise definition of what deal is to be considered a big deal. Conventionally, if the volume of deals in shares of some giant is 50 million shares a day, even a bid of 0.1% of this volume will be a very large deal capable of changing the market. A large bid can form a channel in which the price moves for a certain time, and when it leaves the channel it may indicate a new trend. Or, for example, if the average volume of futures for an index is about 1 million contracts, then a large order will be no less than 2 thousand contracts. It is necessary to pay attention to the order of such volume and, even more so, to the order of even greater volume, and to be guided by them when forecasting prices.

Forex Depth of Market

Where to see the real forex price chartif it exists? Unlike the stock market, liquidity providers to the market and Forex brokers do not present the list of orders in the same form as it is on the exchanges. This is due to the fact that Forex is a decentralized currency market, trading opportunities are provided by many brokers in different countries, there is no unified statistics and therefore there cannot be a single order book for the entire Forex market. In addition, Forex is extremely dynamic and liquid, and it is too difficult a technical task to compile a full order book reflecting the situation on the entire Forex market.

Brokerage glass

Of the brokers, the application list is represented by brokers such as, RoboForex (go online), Alpari (online), NordFX (online) и FBS (go online), which offer the One Click Trading Level 2 plugin. Large companies provide trading functionality for a large number of clients who are constantly trading and generating a large amount of data, on the basis of which you can create quite informative forex price chart online.

In addition, there is no guarantee that the broker provides information about all trades that take place at the moment. Generally, brokers (or big players), since there are no general statistics on the market, have great possibilities to manage the order book. For example, they can place a large offer, stimulating traders to sell or buy more actively. At the same time, a large but bid-offer can be placed at the same time, divided into parts. After redeeming the required volume of lots, the asc is removed and traders are forced to change their tactics in the direction the big player wants.

MT glasses

Nevertheless, there are indicators and charts that are similar to those order lists that are used on exchanges. In the most popular MT4 and MT5 terminals, there is a “Price Watch” chart. In MT5, in order to put a chart in the terminal, you need to go to the “Charts” section and the “Depth of Market” will be at the top of the drop-down list.

Image. 3

This chart provides information on orders to buy and sell assets at the best prices and shows the dynamics of the ratio of sell and buy orders. But the Depth of Market as such does not provide any meaningful information in the MT terminal. It can be used, for example, for testing forex strategies by the order book. The difference from the stock book is that if MT5 is used by a broker, the indicators in the book are formed from the broker’s quotes, and the latter generates prices, which are determined by the volume of supply or demand. Brokers do not provide information on concluded deals.

If the broker does not provide data on the volumes, then the glass can only be used for scalping – the trader places orders directly from the glass, focusing on the Bid and Ask prices. The basis of the “Depth of Market” chart on MT5 is taken as the Bid, for buying. Trading in MT5 is performed by the Buy and Sell buttons at the bottom of the order list. Detailed information about the positions can be found by right-clicking in the sections “Price”, “Trade” and “Volume”.

To make a trade, it is necessary to set a volume. If the trader trades directly from the order book, he acts in the “all or nothing” mode, that is, if after that click on the Buy or Sell button, it will mean consent to conduct a trading operation – and it will be immediately conducted, at current prices. To close a position completely, click on the appropriate button at the bottom of the chart. But pending orders can also be put – if you right click on the price you can choose Buy Limit, Sell Limit, Buy Stop or Sell Stop. The algorithm of actions is the same as at usual trading – as soon as there is a trader ready to buy/sell an asset, the request will be executed.

Indicator

In addition to the “Depth of Market” chart in MT4 and MT5, there are also indicatorsThe FXSSI OrderBook is an example of the FXSSI OrderBook. For example, FXSSI.OrderBook, which shows open trades and pending orders in the form of a double-sided bar chart. It also can’t be compared with the stock market by its functionality, but still it’s a useful tool. OrderBook includes a left-hand online forex marketplace which displays pending orders, and a right-hand marketplace which displays open trades.

The glasses are divided into four parts, each of which displays the type of order. The trader is supposed to look for suspicious clusters of orders or, on the contrary, absence of orders. For example, a cluster of sellers indicates that the price will rise, and conversely, the prevalence of buyers indicates a decrease in price. However, the developers do not recommend basing your trading decisions only on this information, at least you need more practice to make good decisions.

Working with the order book in Forex

As a trading tool only the “Depth of Market” is unlikely to be used effectively, due to its limitations. As a generator Forex signals It’s not very good either. There are no trading advisors based on the order book either. It can be used as an additional tool for technical analysis, and partly for fundamental analysis, and by experienced traders who can understand what the numbers in the table say and apply them to real trading. They evaluate parameters such as the number of limit orders, – to predict the direction of the trend. They keep track of large orders and clusters of orders, – this can show the direction of search for entry points to the market or, conversely, the exit points. Also, the list of orders can give information on the mood of the market participants, which is important, for example, to understand the changes in the speed and strength of the trend.

As practice shows, trading based on the forex online volume chart can be more usefully applied by scalpers. If there is a real opportunity to implement this trading strategy, the orders are placed along the trend. Trading against the trend is possible with the use of pending orders with set take profit and stop loss limits. There is also a forex strategy, at the heart of which is the tracking of the gradual “cutting” of a high density of orders in the stack. This takes into account strong support and resistance levels and trading volume. But, again, this trading system implies the use of other indicators – the Depth of Market offered by brokers is not enough for successful trading.

Initially, there should be a very high density of orders in the stack. The strategy should not be started before the density decreases by 30%. At the same time, there should be strong support and resistance levels and impressive volume, all these parameters should be confirmed for a long time. This implies the emergence of a strong price momentum, which gives the momentum to breathe into the trade. If at least one condition is missing, the position does not open. It is partly similar to price action trading. But for Forex trading, there are plenty of more simple and effective strategies than tumblr trading. So, the best way to use the order book is as an analytical tool.