Cryptocurrency Trading Strategy by Stochastic for 60 Seconds

Stochastic – classical indicator of technical analysis, belonging to the class of oscillators (reviews of all oscillators at InvestMagnates.com). When calculating its readings, the speed of price movement and its intensity are taken into account. It is done by correlating the coefficient of price divergence from the closing rate of the previous time period. Without going into the mathematical details of the calculation formula, we can say that stochastic shows the current strength of an active price trend. This allows traders to make forecasts based on the probability of a price reversal at a certain point in time.

The indicator consists of two lines that move within an area with levels from 0 to 100, and gives three types of signals. First, the position of the two moving averages relative to the levels on the area. Stochastic, as well as RSI, has overbought and oversold zones. Normally they are at 80 and 20. Secondly, the position of the moving averages in relation to each other: which of the lines is above, which is below. Third, the distance between moving averages – a large interval indicates high volatility, while a small interval indicates a decrease in market activity.

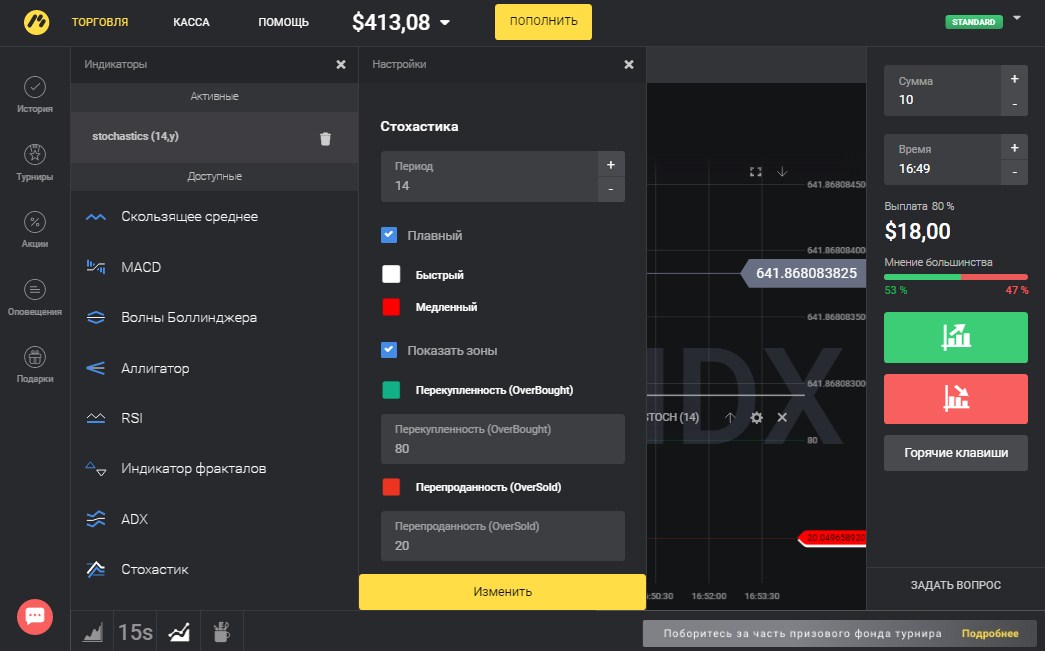

Configuring the trading terminal

The stochastic indicator is a universal tool, which can be used for analysis on any assets and timeframes. However, for 60 second turbo options it is best to choose a crypto-index. CRYPTO IDX in terms of technical analysis allows you to get a price chart of the ideal structure. The minimum allowable interval is 15 seconds, which allows building effective forecasts for turbo options for 60 seconds.

To cryptocurrency trading on the strategy under consideration will need to select the CRYPTO IDX, set the time frame chart for 15 seconds, add a stochastic indicator with default settings (period 14, the levels of 80/20).

Signal to buy “Up” option

Main signals stochastics are interpreted unambiguously. As soon as both muwings cross the boundary of the oversold zone (below 20), an up option should be bought. The white line should be on top of the red line, and at a small distance from it, not intertwined. This is a signal for a reversal downtrend.

The greater the number of times the moving averages intertwined with each other on the eve of the signal, the lower the probability of its passage. Ideally, if on the eve of the stochastic entry into the turning zone (20/80) and the subsequent exit from it, the moving averages will not cross each other, and will run parallel to each other at an equal distance.

Down option buy signal

The stochastic signal to buy the option “Down” is the exit of the moving averages from the overbought area, located at the level above 80. The white moving average in this case falls below the red one. Trade on trend reversals, ignoring periods of short-term correction.

Rules for selection expiration dates standard and are determined depending on the interval on the chart. The duration of the transaction should be equal to 3-5 candles. Trading during a flat (neutral trend) is not allowed.

Cryptocurrency trading by stochastics as an example

It is very easy to open transactions using this oscillator, any beginner can handle it. The scheme is simple, but at the same time effective, provided that the trading is done in a volatile market. In order to consolidate the knowledge gained and to confirm the power of stochastics, let’s conduct one sample deal. Asset: CRYPTO IDX, interval: 15 seconds, expiration time: 1 minute. Trading is done on a real deposit.

On the chart we see a reversal of the upward trend. At the moment of receiving the signal, as soon as the muvings crossed the 80 boundary, we enter the market with the option “Down”. The moment of opening of the trade can be seen in the screenshot above, which was made after 30 seconds.

The picture above captures the moment of expiration of the option. The operation is closed, the trading deposit is credited with a profit of 80%. CRYPTO IDX is characterized by a high percentage of profitability, regardless of the time of day. Which is another advantage of this asset.

Conclusion

Broker INTRADE.BAR offers traders a convenient trading terminal, including Stochastic. This opens a new horizon of possibilities for traders who carry out technical analysis in the trading terminal, which allows the use of turbo options. In this article we considered a classic trading scheme using this indicator. However, the real potential of the stochastic is much higher. On its basis stochastic has been developed dozens of effective strategiesWe will also be reviewing them on our website.

Reviews