The Biden Era: How Will the New States Economy Affect Currencies?

On November 3, the U.S. media announced that Biden had won the U.S. presidential election. The Republicans were replaced by a true Democrat: a man with strong diplomatic skills. They say that Biden does not like radical measures: he is the exact opposite of businessman Trump.

In this article we will talk about the new U.S. economy and its impact on world markets, including currencies (project reviews). For you, as traders, this article is a potential action plan for 2021. And, as always, we recommend working with proven forex brokersFor example, AMarkets (go online). Take advantage.

The New U.S. Economy

Biden is the president-elect. His inauguration will take place on January 20, 2021. The new president will have to fight on two fronts at once:

- To strengthen the economy against the backdrop of the crisis.

- Strengthen the health sector against the backdrop of COVID-19.

For any strategy, Biden needs money. Where will he get it? Take it from the rich and give it to the poor. Very democratic, isn’t it? You got that right: Biden is going to raise taxes on investors, corporations and people with annual incomes over $500,000. Trump did exactly the opposite in his day: cut taxes and let the U.S. business sector grow.

New Vector

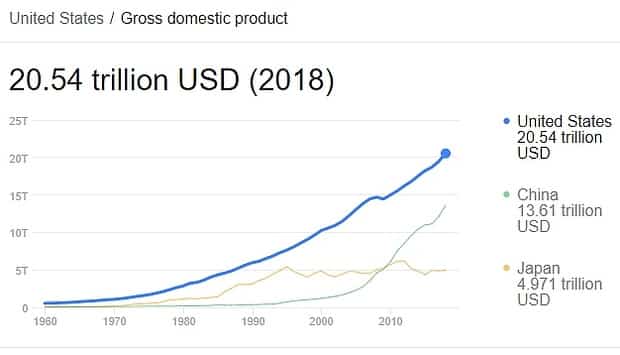

Biden also said that he wants to “revive” the U.S. economy. The president-elect believes that a GDP of 20 trillion dollars is nothing: the states can produce twice as much. Biden will invest in green energy and technology: electric cars, 5G and artificial intelligence. So, as traders, we will be interested in these areas in 2021.

Policy

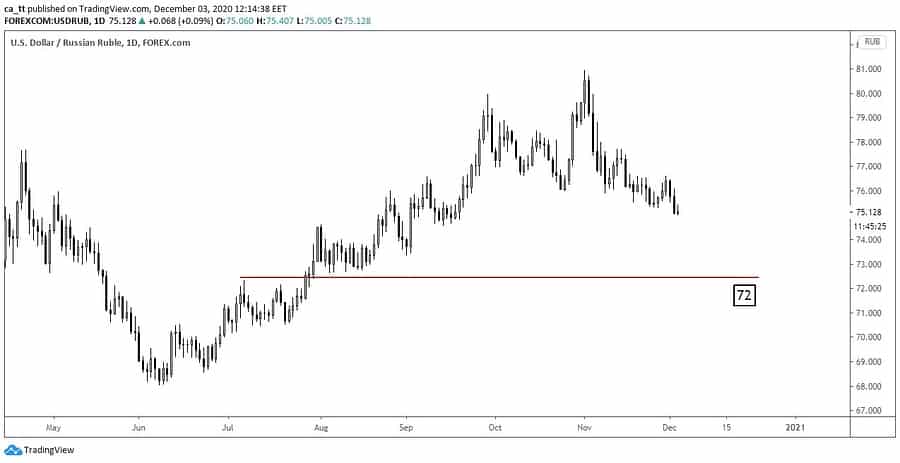

Biden has said many times: Russia is the main threat to the United States. The president-elect has a hell of a sanctions program in his arsenal. He wants to:

- to prohibit investments in Russian energy centers;

- to prohibit transactions in the U.S. territory of Rosbank, including VTB.

And although this program is still a draft, if Biden implements it, the ruble will go down in value. In the meantime, the U.S. is dealing with Trump, who is contesting the election results, and Biden has not yet taken the White House. The dollar is likely to drop to 72-73 rubles. Right now it’s 75:

International trade

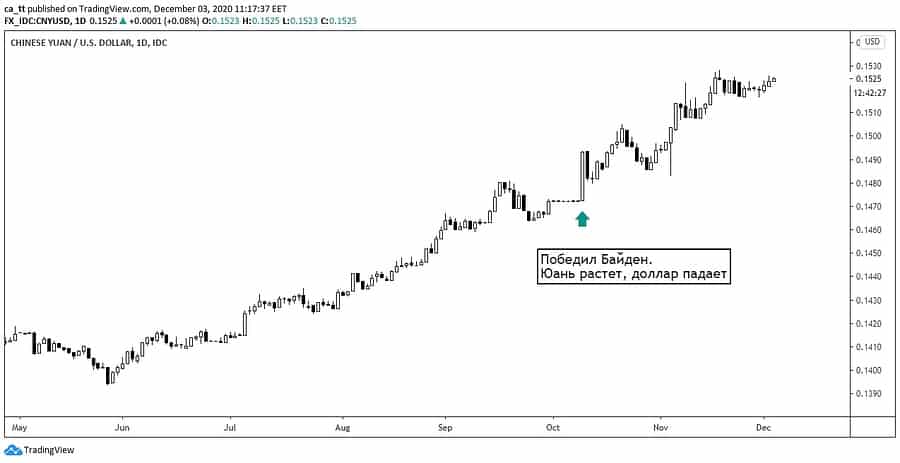

Biden does not approve of the trade sanctions that Trump has imposed. He wants to “put things back the way they were. Not for nothing is his slogan “build back better,” which means “build back better. Biden wants to lower taxes on international trade. And this is big news for China. The yuan is rising for a reason:

The People’s Republic of China hoped that Biden would win. That the Republicans would be replaced by a Democrat, a politician, and a skillful diplomat made China very happy. The PRC is waiting for trade tax cuts and will probably get them in 2021. In the meantime, the yuan is rising:

It can grow another 4% and reach the level of 16 cents. There are no obstacles for the CNY/USD growth.

Dollar

Biden will stimulate the economy. But where will he get the money from? Suppose the state gets the money from taxes. But there has never been a time in the history of the United States when a president has not turned to the printing press, the Federal Reserve, for help. Printing new dollars in 2021 will weaken the USD. So we are unlikely to see a strong dollar. And the euro confirms our theory. As soon as the voting results became known in the US, the Eurodollar came out of the sideways and set a new record, breaking through the 1.20000 level:

The EUR/USD has been sitting in a sideways position for too long. Now the trend is growing, and its upward momentum will reach at least the level of 1.25000:

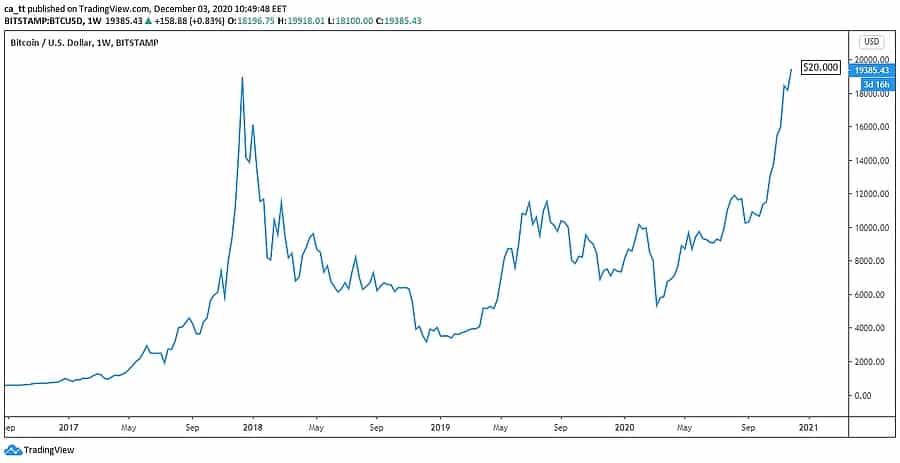

Bitcoin

Not exactly a currency, but still bitcoin is in the spotlight right now. Who would have thought it would grow so much because of the uncertainty of the U.S. election:

Cryptocurrency almost reached $20,000. But this time it is different: they say that cryptocurrency is bought not by small investors from Asia, as it was in 2017, but by large ones from the US (How to Make Money on Cryptocurrency?). In addition PayPal started accepting bitcoin. And Fidelity, a major U.S. investment company, launched its own fund based on BTC. Thus, more and more investors recognize: bitcoin is as good as stocks in long-term investing. Bloomberg writes that BTC/USD will reach $22,000, then roll back to $18,000, and then begin a sideways slide. Analysts believe there won’t be a downturn like in 2018, because this time there are big players in the market who will hold positions for years. So, if you’re thinking of trading bitcoin, don’t buy it above $18,000.

Jena

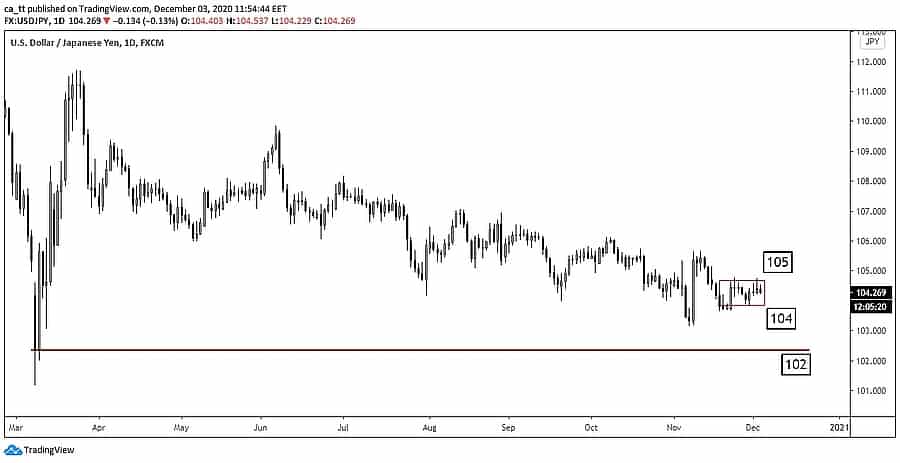

The Japanese yen has always been and always will be a safe haven for investors. When traders do not know what will happen tomorrow, they buy the yen. The U.S. presidential election was a great reason to buy more of this currency. So to say, for confidence in the future:

There are two scenarios for the yen right now:

- The currency will rise to a level of 102.

- The currency will fall to the level of 106.

Right now the price is going sideways. We marked it on the chart. Investors know the results of the election and they are taking money out of the harbor to other, riskier assets. Bitcoin, for example.

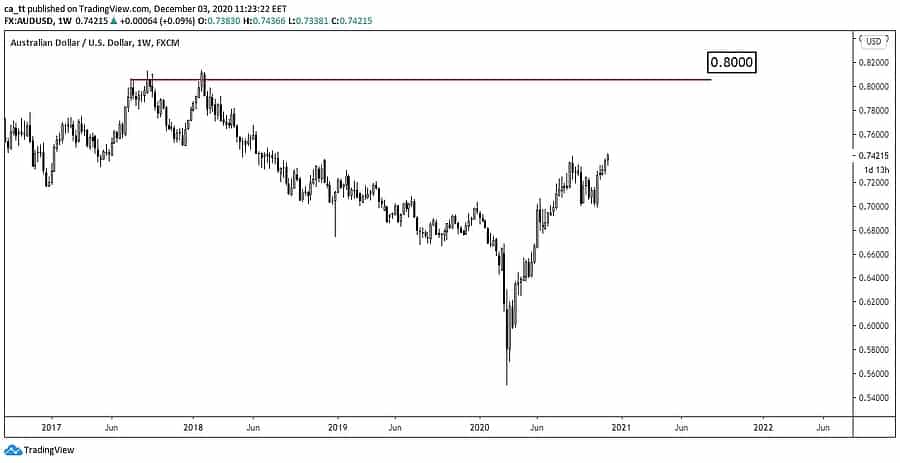

Australian

Despite the fact that AUD/USD is risk sensitive, the Australian dollar has been rising since early November. It certainly likes that Biden will become president:

The Aussie, like other currencies, is showing that the era of Trump’s strong dollar is over. The AUD/USD could rise from 75 cents to 80. You can see on the chart: a serious, long-term rise is on the horizon.

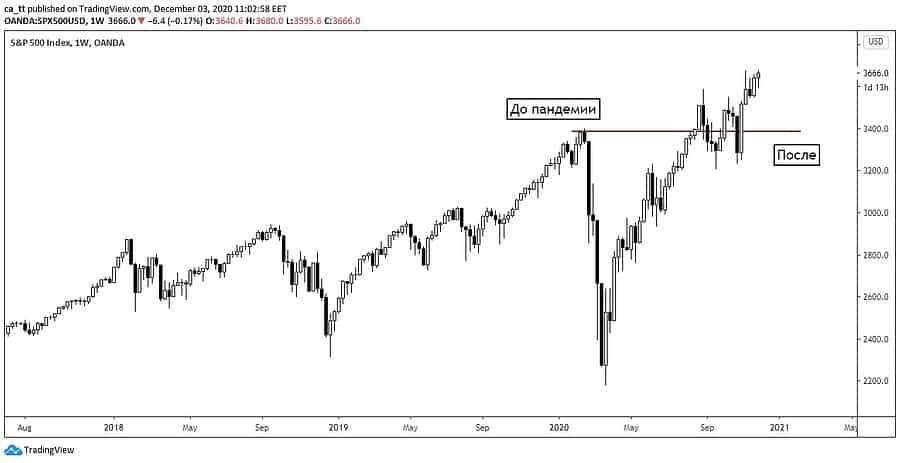

S&P500

Finally, let’s take a look at the Standard & Poor’s 500 Index. It shows the state of the U.S. economy. As you can see, its condition is excellent:

Not only did the index recover what it lost during the pandemic, but it also peaked on the back of the Biden election. The next upside hurdle is the previously unthinkable 4000 level. Up to that level, we predict a smooth, wave-like rise.

Outlook for 2021

With Biden in office, the markets will change:

- the dollar may become cheaper;

- bitcoin – to consolidate at $18,000;

- The yen could go up in price at first, and then get cheaper when the investors come out of it;

- Aussie, the yuan and emerging market currencies could go up.

A Republican capitalist has been replaced by a Democrat. Markets love change and will surely react to Biden’s inauguration on November 21. Stay tuned and don’t miss your chance to make money.

Reviews