Alligator Indicator

Contents

- 1 Alligator indicator description

- 2 Calculation formula

- 3 Advantages of the indicator

- 4 How to add the Alligator to the MetaTrader 4 terminal?

- 5 How to add the Alligator to the MetaTrader 5 terminal?

- 6 How to add Alligator to the broker’s terminal?

- 7 How to install Alligator in the terminal?

- 8 Alligator trade signals

- 9 Alligator Signals in MetaTrader 4

- 10 Alligator Signals in MetaTrader 5

- 11 Alligator Signals at Binarium

- 12 Alligator signals in Binomo

- 13 Strategies of trading with the Alligator

Alligator indicator description

This is also one of the most common tools among financial market players. Although it may seem complicated to work with, it is in fact simple and straightforward, and you don’t have to learn its features for a long time to start working with it.

When working with this tool, traders tend to understand that the market has trendsThe trading is not a clear mood, but most of the time it does not have a pronounced dynamics in a certain direction. If there is a clear mood, traders use it to make their profit and it is the main source of their income. In the moments when the market is “sleeping”, it is customary to “leave” it and wait out such unfavorable its stages. In order to accurately track the moods of asset dynamics, there appeared such an indicative tool as the Alligator, whose author is B. Williams, who created several binary options indicators. What is the Alligator?

It is, if in general, a clever combination of several tools, slides of different colors and period, responsible for the construction of the “alligator” figure. The tool is so called because when it works on a chart it forms an alligator pattern, tracking the state of which you can make a trading decision. Alligator and became widespread due to such a simple and clear interpretation of the market phases. By tracking the behavior of the Alligator, it is easy to understand the state of the market, to enter the deal at the right time, to limit yourself from binary options trading when it is not profitable for the player. This is its significant advantage and, of course, it is a tool that was immediately adopted by the coaches.

This tool consists of several slides:

- blue, which is the jaw of the figure with the period value equal to 13,

- red, which is his teeth with a period value of 8,

- green, which is his lips with a period value of 5.

It is generally believed that if these figures are intertwined, the instrument is “sleeping” or only planning to fall asleep. The longer it has been asleep, the greater its appetite will be. When he wakes up, he yawns, opening his mouth, and then, sensing “food,” proceeds to search for it. After he is full, his interest in such “food” disappears, and all the muvings converge.

Log in to your broker’s terminal, add the Alligator indicator to the chart and see what comes out

| Broker | Bonuses | Open an account |

|---|---|---|

|

1

|

50 %

Bonus on deposit from $100 USD – promo code WELCOME50

|

Start |

|

2

|

5 %

Bonus when depositing via USDT (TRC20)

|

Start |

|

3

|

Cashback

Refunds of commissions, spreads and other costs

|

Start |

|

4

|

15 %

Bonus 15% on deposit by promo code iCGSbEgiAR

|

Start |

|

5

|

100 %

First deposit bonus

|

Start |

Calculation formula

MEDIAN PRICE = (HIGH + LOW)/2,

ALLIGATORS JAW = SMMA (MEDIAN PRICE, 13, 8),

ALLIGATORS TEETH = SMMA (8, 5),

ALLIGATORS LIPS = SMMA (5, 3), where:

MEDIAN PRICE is the median price,

HIGH – maximum value,

LOW is the minimum cost of it,

SMMA (A, B, C) – smoothed sliding. A is the data to be smoothed, B is the period, and C is the shift parameter to the future. For example, SMMA (MEDIAN PRICE, 5, 3) means that this moving average is taken from the median value, the smoothing period here is 5 bars, and the shift is 3.

Advantages of the indicator

The Alligator is one of the most popular trend-following instruments, and there is an explanation for that: it is simple, easy to use, and clear in the information it generates. It is commonly used when it is important to understand the phases of the market, the condition of the traded asset, to filter the stages of the absence of a clear trend (with a sideways range). Three moving periods of 8, 5 and 13, as well as the median value indicator, are used here. Correctly using its capabilities, it is easy enough to track the current sentiment of asset dynamics and profit from it.

Alligator it is fair to consider a separate effective strategy for work, which, unlike complex trading techniques using different tools, generates accurate information, is quite indicative and demonstrative during trading. It is used by both beginners and market professionals, who rely on the information about the stages of Alligator’s “vital activity”: sleep and hunting phases. The tool can accurately determine the moments to enter the market, as well as those situations, when it is better to avoid working on it to reduce your losses.

Most players are known to work in the market during clearly defined trends and by investing money in the position, they get their profit from price fluctuations in a certain direction. Of course, since it is a trending instrument, investors recommend confirming its information with, for example, StochasticsBut it is still a real reliable helper when working with different assets, in a variety of strategies and styles of trading.

Thus, four phases are used when working here:

- Alligator’s awakening as his teeth move away from his jaw, indicating the emergence of a new trend.

- The alligator “eats” and his lips seek to cross the green mouvement.

- He is “full” when his teeth come down to the lower limit and indicate the onset of a peak trend.

- He is “asleep” and his three lines are either weakly interrupted or or close to each other and indicate the end of a trend.

The main advantage of the tool is that by using it, you don’t have to spend a lot of time interpreting its data. Moreover, there is no possibility to interpret this information ambiguously – everything is simple and clear.

How to add the Alligator to the MetaTrader 4 terminal?

Most of the trading platforms popular with players place great emphasis on providing their clients with maximum options for convenient and functional trading. Convenience, responsiveness and availability of different options are what ultimately influences a player’s choice of a particular platform. MT4 is the solution that has earned the trust of players in practice: there are a lot of useful features, it’s easy to implement any methodology, conduct trades, track asset dynamics, carry out auto-trading. Moreover, many standard indicators are available here, including the Alligator. To start working with this tool, you only need to add it to the chart:

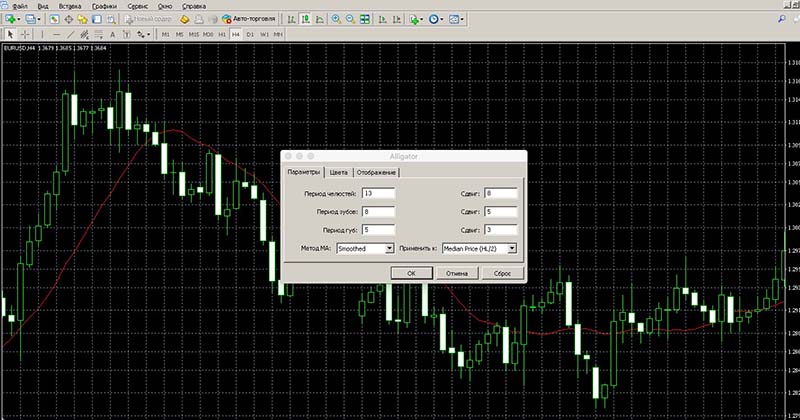

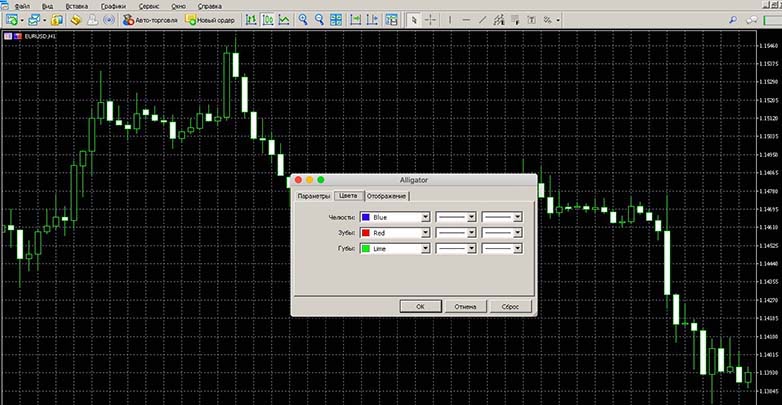

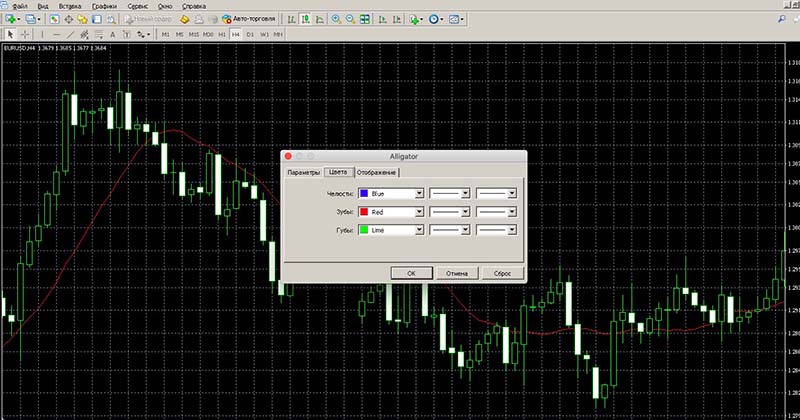

Next, you can do a quick setup here:

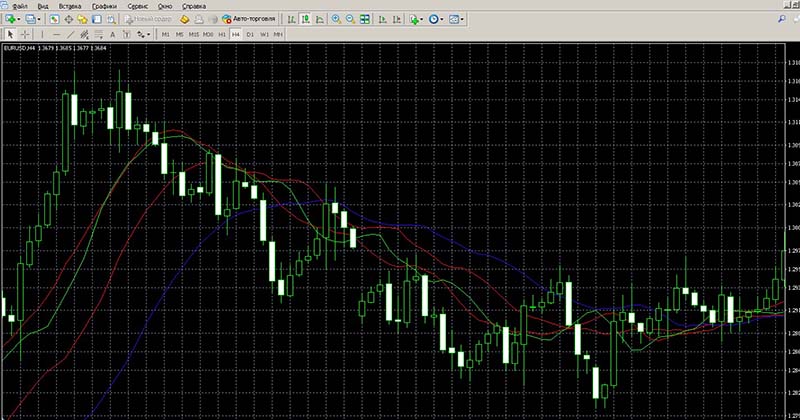

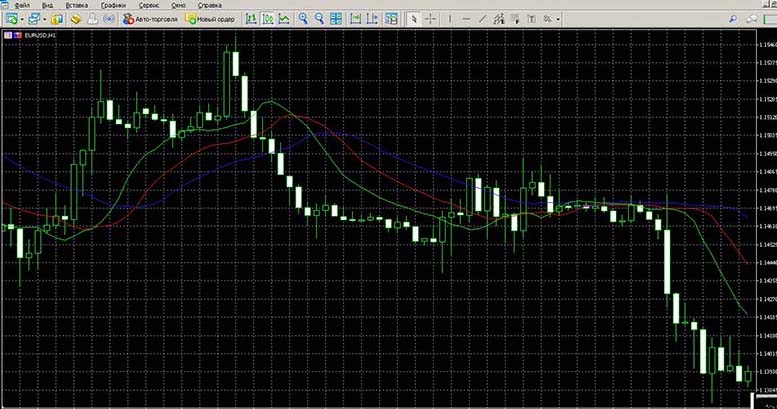

Now you just have to click “OK” and that’s it – you can work with it:

How to add the Alligator to the MetaTrader 5 terminal?

Exactly like its previous version, this terminal immediately became popular with investors after its appearance on the market. Here, in addition to the availability of all the advantages of MT4, even more useful options have appeared, including a set of indicators, originally installed for work. There is also the Alligator:

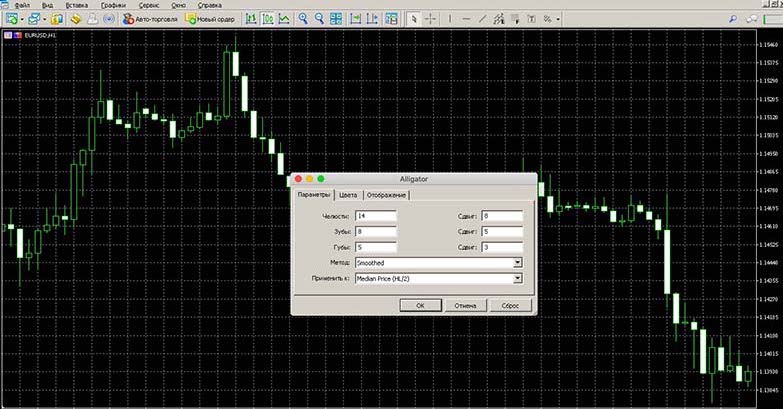

In the program it is also easy to make the necessary adjustments depending on the strategy of working with the asset:

Next, you only need to add it to the chart by using the “OK” button:

How to add Alligator to the broker’s terminal?

- Finmax

Although this brokerage organization is considered one of the best on the market, but one of its significant drawbacks is that there are very few tools available for technical analysis of asset dynamics, only 4 indicators – it is inconvenient and players use third-party platforms to work. There is no alligator here, so in order to use its capabilities, the player will also have to switch to another platform.

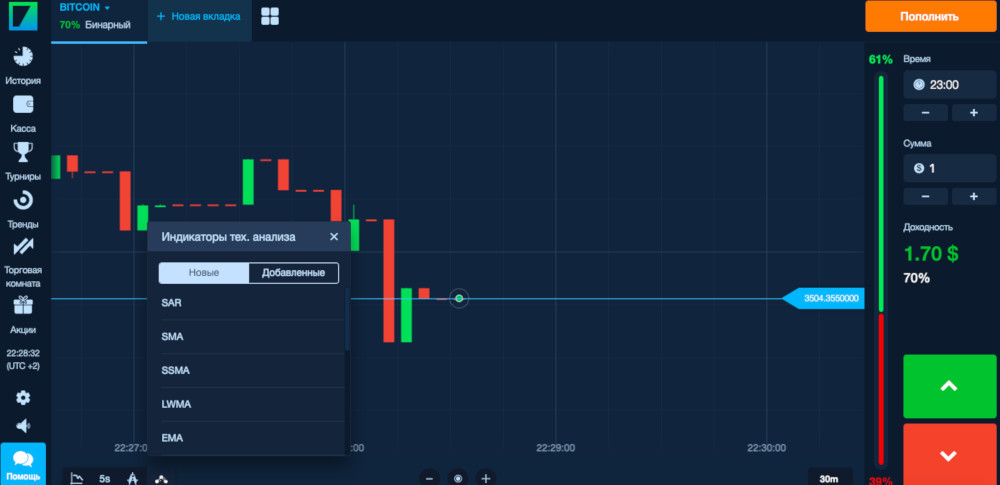

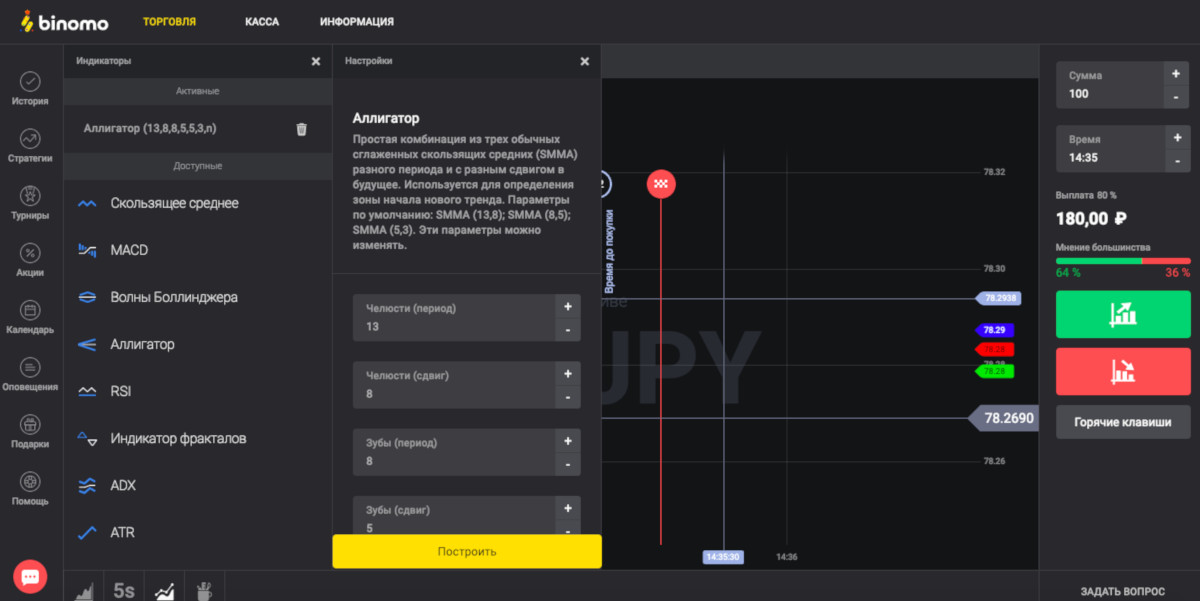

One of the strongest advantages of this brokerage platform is that its clients use one of the most powerful and functional terminals. Maximum possibilities are available here: graphical tools, selection of assets, an impressive set of indicators to implement a variety of strategies and techniques, etc. Alligator can be used here as well. In order to add it to the main workspace, you only need to click on the “Technical Analysis Indicators” button located for convenience in the lower toolbar of the program. In the list that opens you need to select it and, by clicking on its name, add it to the chart:

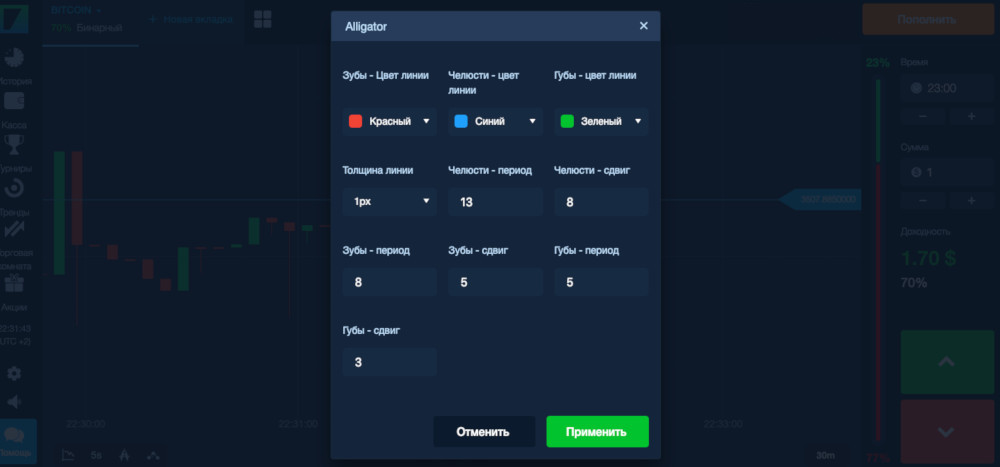

This broker offers to work with advanced tool settings, which is also convenient:

Once you have configured the tool, all you have to do is minimize the settings panel and start trading:

And the platform of this brokerage organization will also be comfortable for a player with different trading experience – it offers a variety of tools, including a set of indicators, which can be easily and quickly set up. Alligator is also available here. In order to attach it to the chart, you need to open the list of indicators – the button of the same name is located on the bottom panel of the platform:

Here you can explore all the tools available for work, choose the Alligator. Also players can customize it as required for the strategy:

After that, you only need to click “Build” and that’s it – you can work:

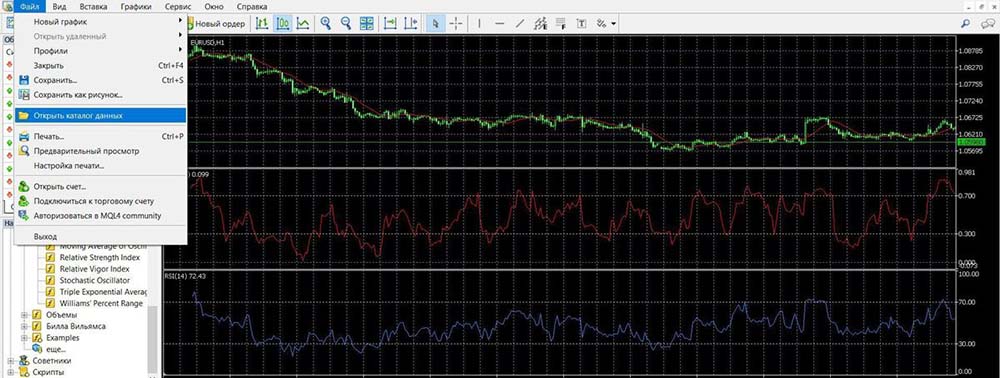

How to install Alligator in the terminal?

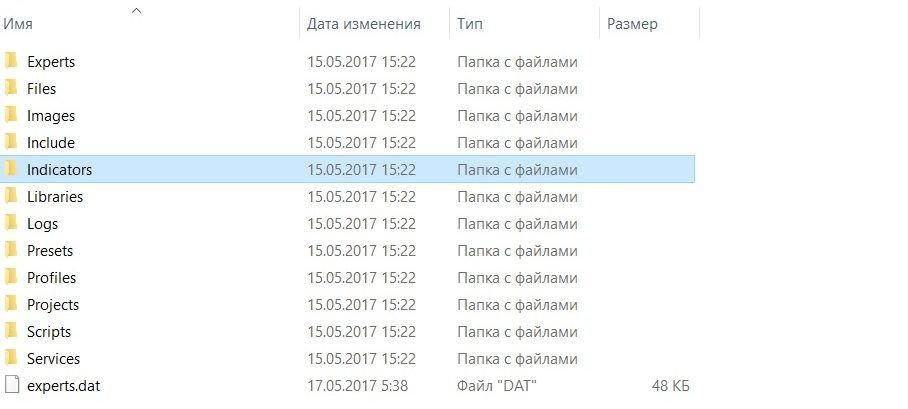

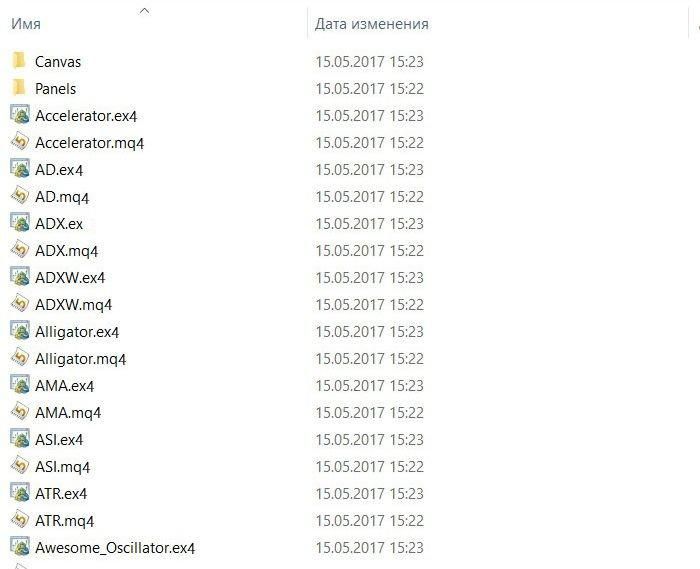

Of course, the Alligator we are considering in this review is in some trading platforms and it is undoubtedly convenient for traders, but not all companies can boast of a functional terminal. In this case, it may help that the platform has an option to add free tools for work and, if it is in the terminal, it is also its advantage. For example, MT4 platform opens unlimited possibilities for players, on which you can add any number of instruments. This process is simple and available to any trader, regardless of experience. Here you only need to find a tool file on the Internet or download it from our website and add it to the special catalog of the program:

In the folder that opens, go to the folder with the indicators:

This is where the tools that the trader adds to the platform are located:

After adding the file of the required instrument here, you only need to restart the trading program (that is, close and reopen it), check its presence in the custom indicators and add it to the trading chart:

Alligator trade signals

In order to correctly use all the features of this powerful tool, you need to know what signals It generates – we’ll talk about that in this part of our review.

Change in price dynamics:

In this case it is very easy to work with the tool:

- If during a price correction, the green line goes under the blue muving down and, showing a reversal, crosses it in the upward direction, it is worth to make lots of KOLL,

- If, however, the green muving has moved above the blue one and crosses it downward during the price correction, it is advisable to place PUT lots.

Determining the phase of the market:

- In the case of a flat, the lines of the instrument are intertwined with each other, indicating that there is no trend on the market, and therefore it is better not to enter the trade:

- When the lines of the tool are divorced and have a clear direction, you can trace the trend and use it in your work as follows:

- If the value line is above the instrument’s muwings, which, in turn, is pointing upward, this is an upward sentiment. In this situation, you can place lots UP; if it is pointing down, the market is in a downward mood, you can work with lots DOWN.

Trend Definition:

Such signals make it possible to determine the new sentiment using the data of the instrument’s muwings, which are first in an intertwined state and then, having “chosen” the direction, rush either downward or upward. At the same time the longer the Alligator is in a state of chaos, the stronger the trend will be:

- Thus, if at the end of the flat the instrument, after awakening, wanted to “eat”, the trend gathers strength: the green muving goes under the blue one, a reversal occurs and then it crosses the blue one upwards. In this case it is possible to execute contracts upwards;

- If the instrument “wants to eat” and the green muving goes under the blue upwards, there is a crossing of the blue downwards, then in this situation it is recommended to work with DOWN contracts.

Alligator Signals in MetaTrader 4

- Changing Price Dynamics

Realization of Upward Bets:

Implementation of the DOWN stakes:

- Determining the phase of the market

Flat on the market:

KOLL betting:

The registration of PUT rates:

- Trend Finder

Buying contracts for growth:

Buying contracts for the fall:

Alligator Signals in MetaTrader 5

- Changing Price Dynamics

Implementation of KOLL bets:

Implementation of PUT rates:

- Determining the phase of the market

Flat on the market:

Placement of bets UP:

The design of the rates DOWN:

- Trend Finder

Buying contracts for growth:

Buying contracts for the fall:

Alligator Signals at Binarium

- Changing Price Dynamics

Realization of Upward Bets:

Implementation of the DOWN stakes:

- Determining the phase of the market

KOLL betting:

Implementation of PUT rates:

- Trend Finder

Buying bets on growth:

Buying bets on the fall:

Alligator signals in Binomo

- Changing Price Dynamics

Realization of Upward Bets:

Implementation of the DOWN stakes:

- Determining the phase of the market

The implementation of growth bets:

The execution of bets on the fall:

- Trend Finder

Buying contracts for growth:

Buying contracts for the fall:

Strategies of trading with the Alligator

This is one of the productive techniques that, through the use of precise tools (MACD and Alligator), will guarantee an increase in profits – about 20% during the week. In this case, the Alligator allows you to identify the current market sentiment, as well as their timely change. The MACD also shows the change of trends, here acting as a filter of information. Both of these tools in such a “duet” are aimed at getting accurate data to enter the trades and to guarantee the increase of the deposit.

In order to place a call bet, the following situation must be identified on the asset chart: the MACD must move upwards; the second service also points upwards, its blue and green lines crossing each other and pointing upwards. To establish a PUT position, a situation must occur on the chart where the MACD is heading downwards and the second service is also pointing downwards, with its lines crossing and heading downwards.

This system is the result of impressive work on the binary market, a product of studying its regularities. It is focused on high-speed betting and will be a suitable strategy for players with any trading experience. Through the use of serious services, it can generate accurate data and bring a decent income: Best Holy Grail Indicator V3, which is based on the work of such services: Alligator, Bollinger Bands and Ishimoku and is able to identify short-term corrections and medium-term trends; USC Murrey Math Oscillator, which is oscillator based on Murray levels indicatorThe CM_Stochastic POP Method 1_V1 is an additional tool, which can filter out false information in time and maximize the possibilities of the system.

In order to place positions UP, it is necessary to wait for the appearance of the following signals: CM_Stochastic POP Method 1_V1 should demonstrate growth with a moving average; the Best Holy Grail Indicator V3 in this case there is a crossing downwards of its moving average; USC Murrey Math Oscillator, having formed above 0, becomes green. In order to form a position DOWN, it is necessary to wait for the appearance of the following signals: CM_Stochastic POP Method 1_V1 with a muving should show the fall; Best Holy Grail Indicator V3 at this time there is a downward crossover of its muving; USC Murrey Math Oscillator, having formed under 0, becomes red.

This high-class scalping system is focused on stable capital acceleration. It is based on the use of the most effective tools with perfect algorithms and quick reaction to the dynamics of assets. Using this trading method on the futures market, it is possible to open about 15 positions, and 87% of them will be profitable. The following services are used in the strategy: powerful CM_Renko Overlay Bars V1, which is indispensable for finding new trends; TDMACD is a variant of the tool familiar to traders and capable of generating even more accurate indicators to enter the trade; Williams21EMA13 is an oscillator based on such tools as MA and Alligator. All of these indicators aim to offer the trader a high-tech working methodology that generates accurate signals.

The following set of signals is recommended for searching the moments of the growing trend: CM_Renko Overlay Bars V1 should form crosses (green) under the cost candlesticks; TDMACD should break the slow moving one heading upwards with a fast moving average and Williams21EMA13 should confirm an increasing trend with a clear divergence of its moving average upwards. To look for a downtrend situation we recommend the following signal set: CM_Renko Overlay Bars V1 must form crosses (purple) above the candlesticks; TDMACD must use a fast moving average to break the slow moving average, going down; and Williams21EMA13 must again confirm a downtrend by a clear divergence below its muwings.

This system, created by an unknown trader, allows you to easily make the work with the market productive, to carry out its analytics more effectively and dynamically increase the state of the account. It is based on the use of two powerful trend tools: MACD and Alligator. It is this combination of their capabilities allows you to get the points of trend reversal and the emergence of new sentiment. The Alligator’s role in this system is to generate information about market phases; the MACD’s role is to identify market reversals. Both of these tools, acting as an insurance and information filter, generate accurate information about profitable market positions.

To find signals of an increasing trend the following set of signals of this technique is recommended: the green alligator muving breaks up its other lines, which is an identification of an increasing trend; at the same time the white MACD muving crosses up the red one, which indicates a reversal of the mood.