Break Down” Strategy on Bollinger Bands and RSI

Bollinger Bands – one of the basic indicators, which is available directly on the trading INTRADE.BAR platform. We also recommend that you explore the possibilities of such trading platforms as PocketOption, Binomo, Binarium.

Bollinger Bands allows you to determine the coefficient of divergence of the current price position on the chart relative to its expected position. When applied to the chart, it forms a price corridor based on the RMS deviation for a specified period of time. The Bollinger wave is divided into two parts by the middle moving average. The indicator feeds several types trading signals: the crossing of the average level, reflection from the borders of the channel and their breach.

Contents

Installation of additional filters allows you to increase the accuracy of prediction. The “Break Down” strategy implies the use of an auxiliary indicator – RSI. The oscillator will allow to recognize the points of violation of the balance of forces “bulls” and “bears” in one of the sides. It allows to filter reliable signals about the upcoming price correction from false “noise” in the form of chaotic and short-term price jumps.

Setting up the trading platform

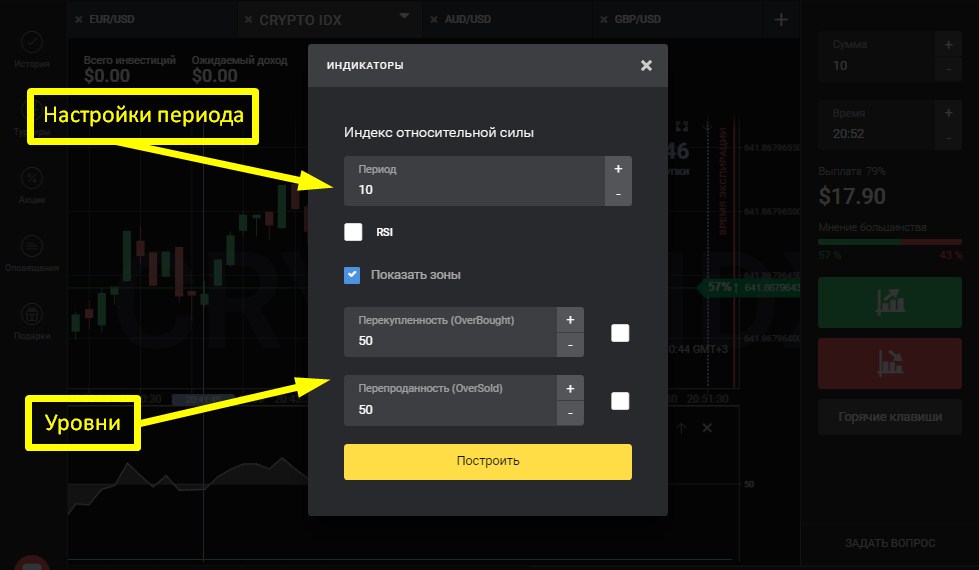

Two indicators should be added to the Intrade.Bar terminal – Bollinger Bands and RSI. Bollinger Bands settings should not be changed, we leave the default settings. And the standard parameters of the Relative Strength Index need some adjustments. It is required, firstly, to reduce the period from 14 to 10, and secondly, to set the OverBought and OverSold levels to 50.

You can trade on any assetsBut they have to be sufficiently volatile. If you prefer turbo options trading, then in small intervals (15 – 60 seconds) it is best to use CRYPTO IDX. Also a good option is the EUR/USD during the U.S.-European trading session from 16 to 20 hours Moscow time. About rules of a choice of term of expiration and the sum of the investment will be separately told below.

The signal to buy the option “Up”

The balance of forces in the market should shift to the “bulls” pushing the price up. Signs of this are as follows:

- The green candle breaks through the middle line of the Bollinger Wave;

- The RSI crosses the set zone boundary, entering the OverBought area.

An example of a valid signal is shown in the picture above – marked with a yellow marker.

The signal to buy the option “Down”

The opening of the trading operation to sell is carried out at the moment of the change in the balance of power in the market in favor of the “Bears”, reducing the performance of quotations. This is evidenced by the following indicator signals:

- the red candle crosses the middle (purple) Bollinger Bands line;

- indicator “Relative Strength Index” goes to the set OverSold zone.

The above is an example of a signal. Compared to the previous one, it is of higher quality, since the market volatility is higher. Between touching the upper boundary of the Wave and the breakdown of the middle Moving Average only one candle could fit.

Example of real strategy trading

To clearly prove the effectiveness of the “Break Down” strategy and consolidate the information obtained, we will give an example of trading according to the considered scheme on a real deposit.

In the trading terminal, the currency pair EUR/USD was selected with a chart interval of 30 seconds. Expiration is equal to 2 minutes. The amount of investment is 10 dollars. On the deposit initially there was $303.

In the picture above, you can see that the market entry was made a little earlier than the signal. The price has not yet broken through the Bollinger Bands moving average and the RSI has not crossed the zone boundary. However, given the sharp jump in price, when within one candle was passed the distance from the upper boundary of the channel, it was decided to enter the market.

Two minutes have passed. The trading system along with intuition did not let us down. We got our 81% of profit from the cost of the option – that’s $8 net profit.

Expiration and money management

The considered trading strategy allows to predict the probable behavior of the price for the next 3-5 price formations. The exact timing depends on the selected timeframe. In our example it is 2 minutes. For trading on the 15-second interval it is worth choosing turbo options with an expiration time of 60 seconds; on the minute – with a duration of 4 – 2 seconds. 5 minutes etc.

Money management allows you to insure yourself against possible financial losses. Therefore, you cannot invest more than 5% of your balance in one trade. The recommended value of one option is less than 1%, but for this purpose on the account should be more than 100 USD.

An important point about strategy

Before the breakdown of the middle level, the price must necessarily reflect from the opposite border of the channel. It is desirable that from the moment of touching the lower or upper line passed not more than 5-10 candles, the optimal value – 2-3. If the price has been somewhere in the middle for a long time, it indicates a weak trend and a temporary “lull” in the market. It is better to skip such a signal, as the probability of its passage is reduced.

Reviews