Trading Binary Options on the News

Don’t look for risk in the chance; look for chance in the risk.

Bodo Schaeffer

Earlier we have analyzed trading strategies trend-wise and counter-trendNow let’s start trading on the news. What does a trader need to make a profit? VolatilityThe price movement. You can’t make much money in an inactive market, unless of course you have a couple of billion dollars under management, and open positions are measured in hundreds of millions. Then you catch the slightest fluctuations in a couple of ticks, and they bring a profit with many zeros. As for us, private traders with a limited capital, we are interested in powerful price movements. И News – This is exactly the kind of thing that can provoke them.

Contents

- 1 Trading binary options on the news – not for novice traders?

- 2 Trading on the news: Features

- 3 How to effectively trade on news and events?

- 4 Trading on the news with currencies

- 5 Trading on the stock news

- 6 Trading on the news: the main fallacies of the crowd

- 7 Market news: strange cautions

- 8 How to trade on the news?

- 9 Trading on the news: tips

- 10 Trading strategy on the news at Finmax broker

- 11 Trading on the news: risk management

- 12 Trading on the news: closing words

Trading binary options on the news – not for novice traders?

Perhaps, strategy on the news is one of the most popular ways trading in binary options. This is said to be the simplest and most accessible form of options trading. Imagine a situation – a certain company launched a new product today and all you have to do is predict that the share price of this company will go up, right? Well, it’s not. In fact, this situation is much more complicated than it seems. Trading on the news is not recommended for beginners and we will explain to you why.

Trading binary options on the news is really only recommended for mid to high level traders. All because the value of an asset tends to be most unstable during an important, related news event. Beginners will definitely face problems predicting the movement of an asset during special events. Nevertheless, binary options news obviously remains one of the best ways to make money online (video), but only if you follow a few well-established principles.

Trading on the news: Features

If you have taken up binary options and want to make it your main income, you may want to try some other strategiesThe market is almost impossible to predict market movements immediately prior to the release of important news or events related to it. Predicting market movements is virtually impossible immediately before and immediately after the release of important news, or events related to new asset. Only a small fraction of experienced traders can say confidently enough what will happen next, they use their experience, analytics and details of a particular news event. What are the peculiarities of trading on the news?

Very high price fluctuations

The most important reason why beginners should not trade on the news is that the value of an asset can fluctuate wildly before and after the main event takes place. During these periods, asset movements are almost always unpredictable. Often even experts are unsure of how to make the right choice. Nevertheless, trading on the news becomes much easier some time after the release of information about the event. Below we offer you a few rules to help you trade binary options on the news effectively.

The 15 Minute Rule

What we have already talked about above, and we will say it again – the value of the asset can fluctuate in a wide range after the event has already occurred, but also shortly before it is announced, as well as during the event and in case the event was planned and announced additionally.

Thus, if you are an experienced and perhaps impatient trader, you should not trade during the 15 minutes immediately before the event and the 15 minutes immediately after it is announced. During this time, the movement in the markets is not predictable because of the large number of trades being executed by others (mostly by newcomers who have no experience or the slightest idea of what is still going on). At this time, you can see quite dramatic price swings over very short periods of time that don’t seem to make any sense at all. So surely the need to avoid trading in the first 15 minutes immediately before and 15 minutes after a news release will play to your advantage by not stressing you out with possible losses.

The 30 Minute Rule

If you are a mid-level trader and have a little more patience, you probably shouldn’t trade for 30 minutes immediately before an asset event and for 30 minutes after it has occurred. This is based on the same considerations mentioned above. Price fluctuations are less severe than before and after the 15th minute, but they are still significant. Thus, if you are not yet a market expert, you should avoid trading in those minutes.

How to effectively trade on news and events?

So now you know exactly what periods of time you should avoid trading. However, you are still not aware of when you will have the best chance of increasing your capital in trading the news.

The answer is this: you will have the best odds of winning in binary options if you start trading before the 30 minutes expiry time at the time the asset event occurs, or 30 minutes after it has already occurred. Let’s explain why this is the case:

30 minutes before the start of the event

Before an event happens, there is a general consensus about its nature. Here is a great example-if Apple plans to launch its new product in a few hours, most people will assume that the product will be of good quality and will have a positive impact on the company’s stock.

In this case, it is very likely that Apple’s share price will increase during this time. You will be able to buy appropriate option contracts in this situation. However, when there is about 30 minutes left until the product launch, everyone will literally start to go crazy. Millions of people start speculating, buying and selling, and the company’s stock price will jump up and down.

30 minutes after the event

During the first 30 minutes a lot of speculators are still actively trading, which leads to price jumps, seemingly without any logic at all. However, after the first 30 minutes, the asset stabilizes and starts to either continuously increase or decrease. This happens because after 30 minutes (in the case of a product launch, for example) people will already be able to assess the nature of the event.

As in our example of Apple, by the 30th minute of launching a product, you will already be able to gauge the importance of the product released. If you see that the company has released something significant, rest assured that Apple’s stock price will increase. However, if the product is not of much interest or is a minor upgrade of a previous product, then you know that the company’s share price will decrease. This way you can make correct predictions and make a lot of money.

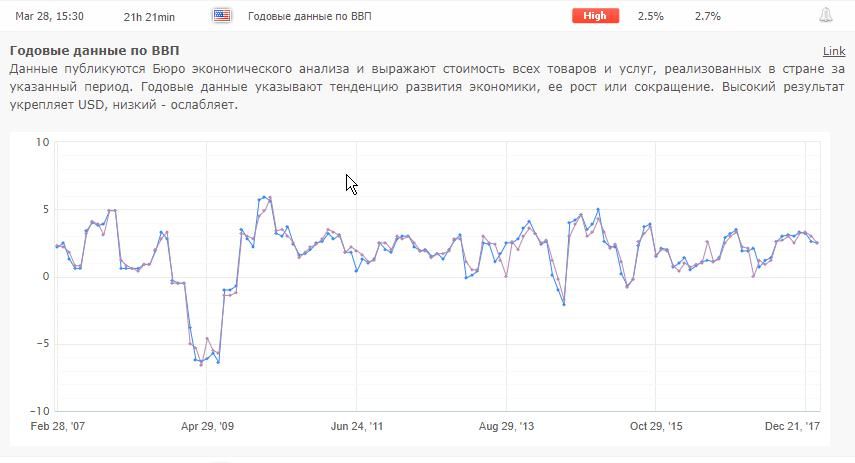

Trading on the news with currencies

One of the most popular ways to trade binary options is to trade on news involving currencies. The best option here is to trade on the non-farm payroll report, which is published by the U.S. Department of Labor every third Friday of the month. This report is last month’s U.S. labor force statistics. The report reflects the total number of how many new jobs were created or, conversely, how many were lost in the U.S. during the previous month. This report always affects the conversion rate of the U.S. dollar against other currencies. There are two basic scenarios that you need to take into account:

Many new jobs were created in the last month

In this case, the dollar will increase in value. You should make your forecast that the exchange rate of USD/XXX (XXX is another currency) will go down as the dollar has become stronger because more investors have invested in USD, knowing that the US economy increased last month due to job creation.

Many jobs were lost last month

In this case, the value of the dollar as a currency will fall due to the fact that job losses indicate stagnation and a decline in economic production. You must buy a binary options contract which predicts an increase in the USD/XXX exchange rate (that is, the USD will depreciate).

Trading on the stock news

We have already dealt with this situation in our examples above. As has already become clear, the most common news related to companies involves a product launch. If the general consensus is formed that a company’s product launch will be successful, then that company’s stock is expected to rise.

If it becomes obvious after about 30 minutes of launching a product that it is really significant, then the value of the company will naturally increase. It will be easy enough for you to make good predictions in these cases. But, again, you should avoid bidding for 30 or 15 minutes before the product launch and 15 or 30 minutes after the official release of the product. This advice is extremely important.

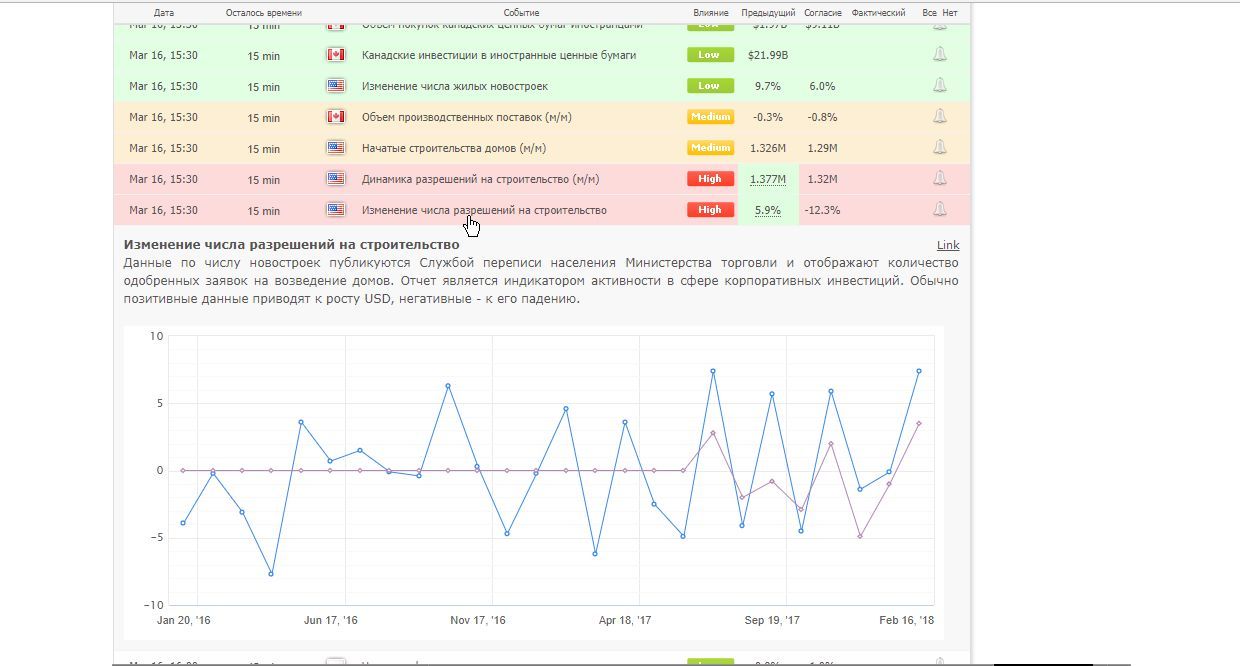

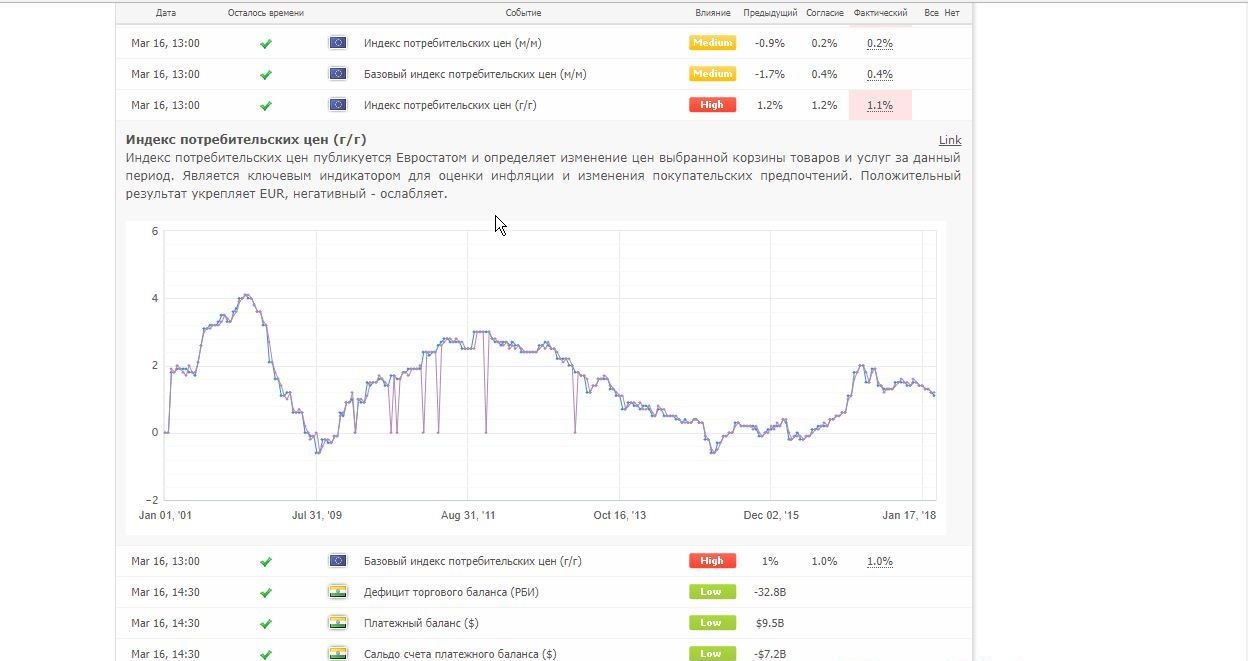

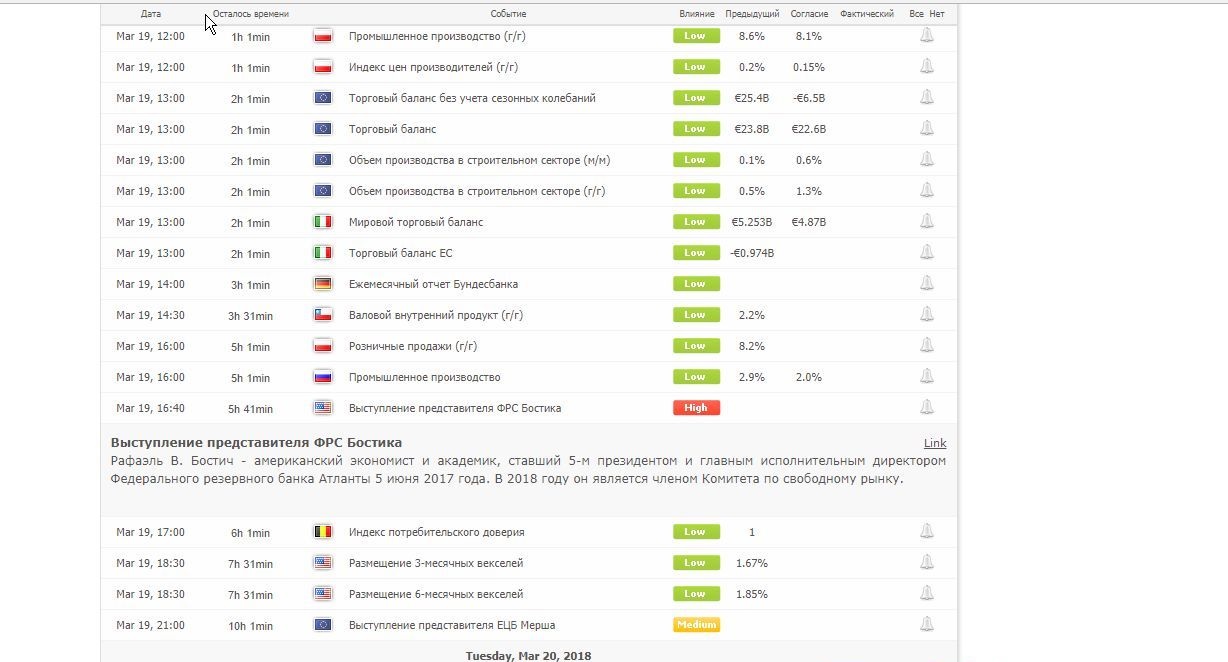

Trading on the news: the main fallacies of the crowd

Going to any site with economic calendar online for the first time, a person will be surprised and confused. Dozens and hundreds of news stories follow each other every day in a continuous stream, flashing graphics, numbers, percentages, quotes from politicians, etc. Brief news descriptions are usually unapologetically confident:

The other news on the dollar:

Or so:

More news on the euro:

Tip: stay tunedThe price of the securities market in the USA, which is connected with the speeches of the US Federal Reserve System representatives, usually shows powerful price movements:

Everything seems to be simple: you wait for the news release, see a certain figure – trade by it. If the news strengthens the Euro – buy, if it negatively affects the dollar – sell. Everything would be fine, but it does not work this way, prices do not behave accurately according to these predictions.

Market news: strange cautions

However, in the analytical reviews from the “gurus” financial markets we will read: “At such a time is expected the release of important news – it is better to be out of the market. So, are we being warned against the possibility of making good money? Or from the possibility of going bankrupt? It turns out – from both, depending on the situation.

Over the years of practical work I have seen the market reaction to news thousands of times. Conventionally it can be divided as follows, with a probability of about one in three:

Option No. 1: the market reacts as expected.

For example, if good news about the U.S. unemployment rate (initial or resubstantial jobless claims) appears and the U.S. dollar really strengthens, the EURUSD goes down mightily (by more than 500 ticks).

Option No. 2: The market is reacting just the opposite of expectations.

Exactly the same – good news on the U.S. unemployment, but the dollar is also rapidly weakening, the EURUSD pair is tearing up.

Option No. 3: the market does not react in any way.

The news can be the most wonderful (or conversely, the most unsatisfactory) – and the price seems to be frozen in place. The usual market volatilityThe “fluttering” of the price plus/minus 200-300 ticks is not taken into account.

After what has happened (always in hindsight), the same analysts will popularly explain anything to us. We will hear: “The bulls took the initiative, because the hourly chart has a “head and shoulders”, “Market makers got the crowd again, as you can see on the VSA volumes”, or “The overbought has exceeded the oversold, which is obvious from the divergence moving averages and shadows Ishimoku clouds“. As if all this gibberish brings any clarity to the situation. It is important to understand that there is only one law in the marketplace:

There are no laws, no one owes anyone anything here.

The dollar may, but should not, appreciate after the good (or bad) news. Or it might not. Or it may not react at all. So what do we traders do in these situations, which sometimes arise several times a day? There is a solution.

You have to be prepared for any development of the situation:

- Recognize current trend (how to do this – we spoke in previous articles).

- In obtaining reliable and time-tested trading signals – Open positions and follow the market.

- Observe Risk ManagementYour open positions should not be “killed” by a powerful price movement in the opposite direction, by 150-200 pips at least.

Did your prediction of a price move come true? Great! The market is just showing you the true direction, so don’t miss this opportunity, Trade against the trend.

How to trade on the news?

For your trading on this trading system to be effective, follow the signals listed in our article:

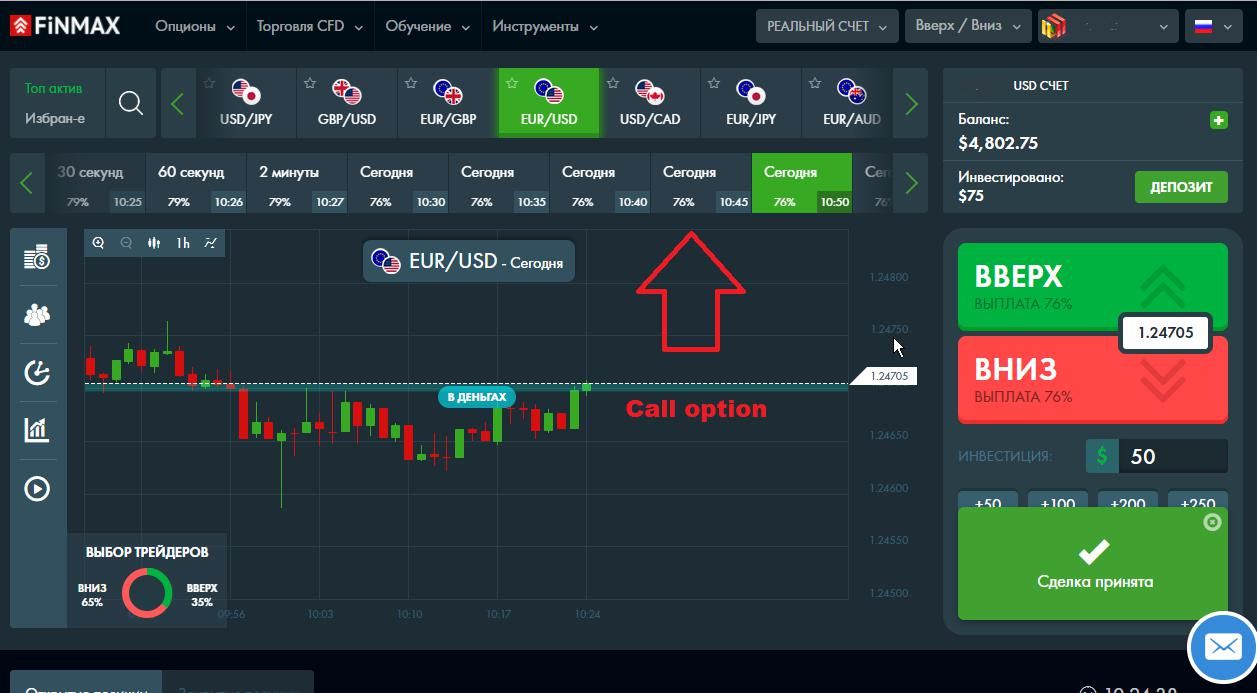

Buying a KOLL option

1. economic calendar for the day on which you plan to trade by selecting an option (for example, currency pair),

2. Conduct a fundamental and technical analysis of the selected pair, recognize the long-term bullish trend,

3. if the price moves strongly upward on the news, buy a call option:

Buying a PUT option

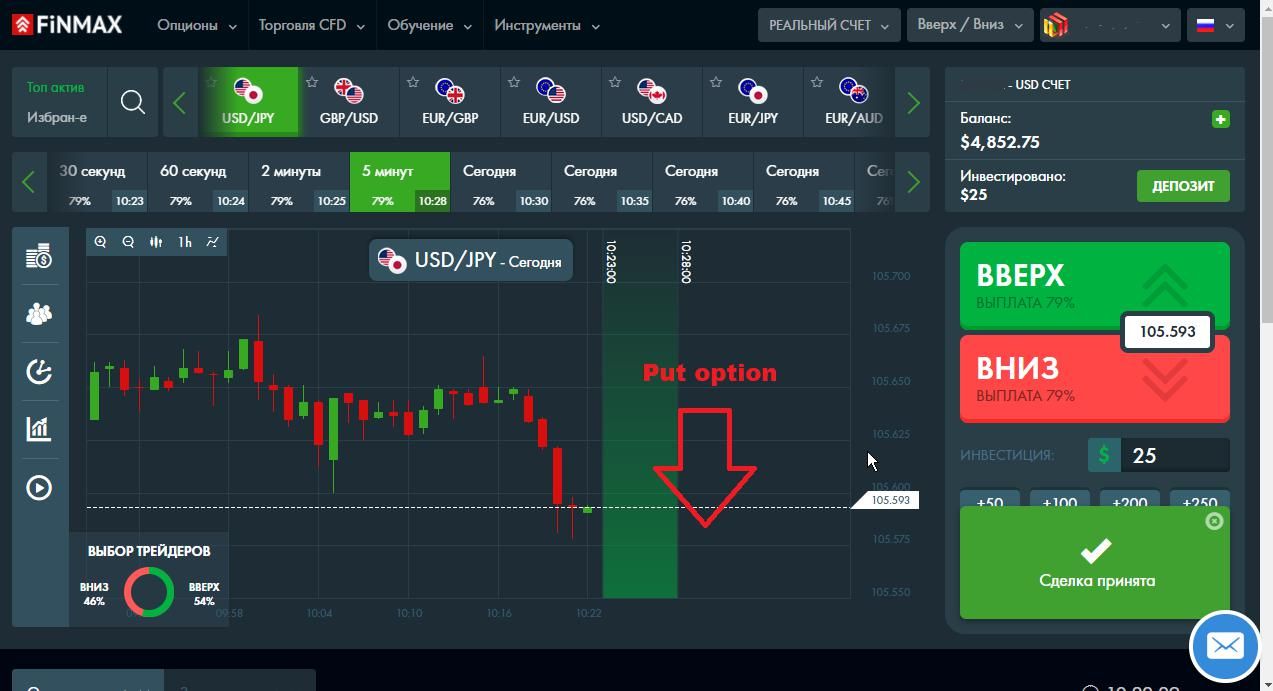

Examine the economic calendar for the day on which you plan to trade by selecting an option (for example, a currency pair),

2. Conduct a fundamental and technical analysis of the chosen pair, recognize the long-term bearish trend,

3. if the price goes down strongly on the news – buy a PUT option:

Trading on the news: tips

- Don’t try to outrun market – it is impossible. Before we can blink (this is not an allegory – we count in milliseconds, i.e., thousandths of a second) they will react trading robotsThe world of professionalism, which since the 1990s has been firmly “occupied” by them. binary trading. The big companies pay them tens of millions of dollars for a few milliseconds of advantage, and apparently the costs pay off – otherwise they wouldn’t pay. I recommend the book by Michael Lewis for those interested (wikipedia) “Flash Boys. The High Frequency Revolution on Wall Street” (read online at a third-party site).

- Don’t have the habit of constantly news monitoringIt probably won’t increase your profits, but losses are very likely. Don’t make following financial news your addiction. The most important thing in trading is to make decisions, and that requires a fresh mind.

- A scientific study of the behavior of 1,000 adults conducted by the University of London found that regular e-mail and texting reduces intelligence and mental performance more than regular marijuana use. We have to assume it’s about the same with news addiction. Don’t make news your drug of choice.

- It’s not the news itself that matters, but two things: a) how the market reacts to the news and b) how you react to the market’s behavior. A simple sequence of actions: news brings (or doesn’t bring) the market into motion, you react to this movement without worrying about whether the price is going “right” or “wrong”.

- If the market corrects you, ruins your original plans and calculations – tell it “thank you” and earn on the opposite movement. He who has told you the truth is your friend. The ability to act on the situation, not to cling to old calculations and forecasts is the most important trait of a true professional. Learn it.

Trading strategy on the news at Finmax broker

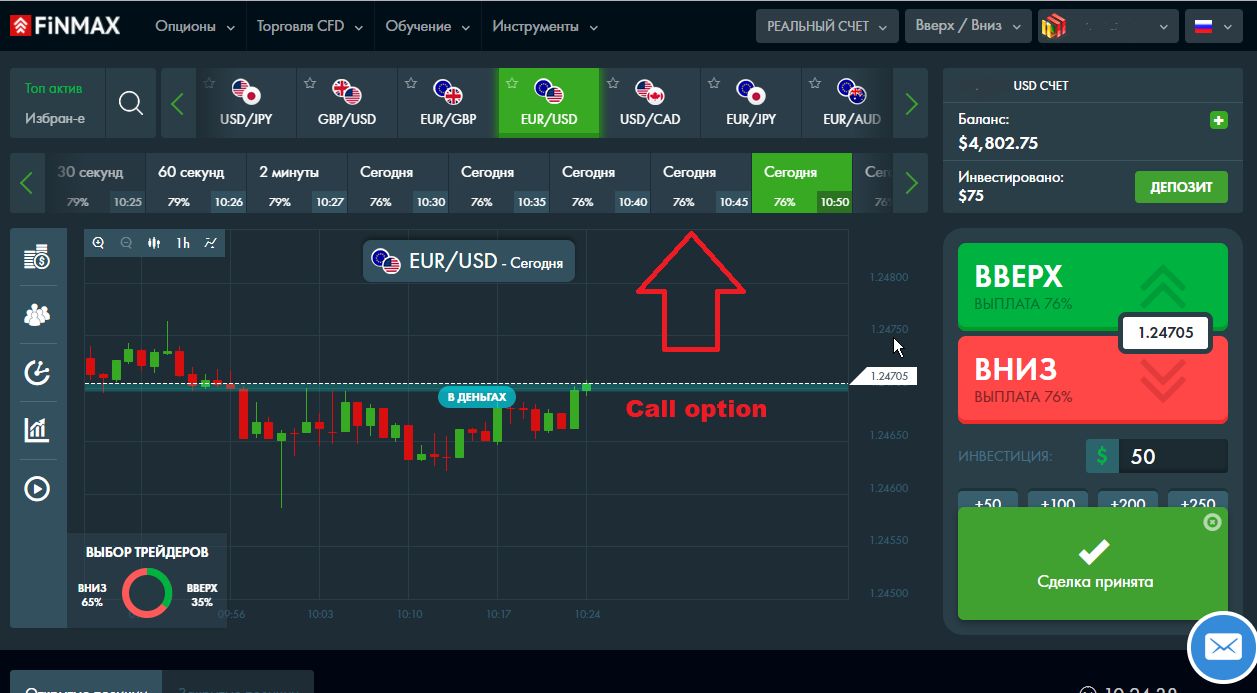

To buy a KOLL option in Finmax’s trading platform, go to finmaxbo.com and prepare an option by specifying:

- Asset: EURUSD

- Expiration: 20 minutes

- Bid size: 50$

- Forecast of price movement: UP

- Clicking the “Buy” button – follow the result:

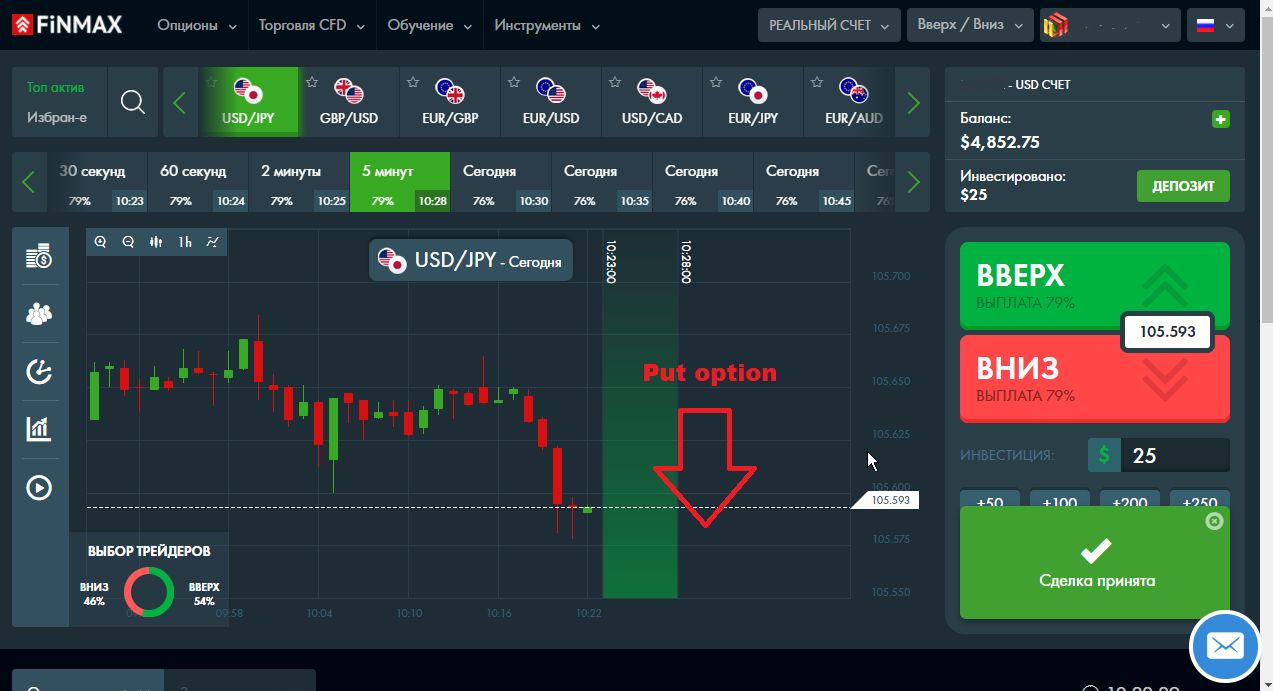

To buy a PUT option in the Finmax trading terminal, go to finmaxbo.com and prepare an option by specifying

- Asset: USDJPY

- Expiration: 5 minutes

- Rate size: 25$

- Price movement forecast: DOWN

- Clicking the “Buy” button – follow the result:

Trading on the news: risk management

Experienced traders say, “Profits take care of themselves, losses never do. Learn to think like a professional. Amateurs are in the clouds, dreaming of big winnings. Professionals, on the other hand, are more concerned about losses, namely how to prevent or minimize them. The only important point is a stable excess of profits over losses, as in any other business. The professional is not the one who does not lose, but the one who earns more losses.

Trading on the news: closing words

As stated in the preface, if you are, in general, still new to the binary options market, perhaps to trade binary options on the news you would be wise to start gaining your first trading experience by working with other strategies. For experienced traders, this article will not reveal anything supernatural, but it will convince you more than once in the correctness and logic of the given recommendations.

More articles on the topic: “Trading binary options on the news